「為替介入」と聞くと、加熱した動きと、反転を警戒する緊張感にあふれた相場状況を想像させられ、それだけでも気もちがザワつく人もいるのではないでしょうか?

「FX専門用語解説シリーズ」として、FXにまつわる用語・単語を取り上げていますが、この記事では為替介入の基本的な意味と、世界各国で行われた為替介入について解説していきます。

為替介入とは?

為替介入とは、その国の中央銀行(日本の場合は日本銀行)が、自国の通貨価値を安定させるために行う為替取引のことで、正しくは「外国為替平衡操作」といいます。

普段の為替市場は、ときには突発的な値動きが発生することもありますが、大抵はすぐに相場は落ち着きを取り戻し、極端な為替レートの変動は起き難いものです。

しかし、深刻な財政問題や経済を揺るがす大事件などが原因となって、市場参加者の投機的な思惑やパニックが生じた結果、非常に大きくて一方的なトレンド相場が発生する場合があります。

こうしたパニック的な短期間での大きな為替レートの動きは、その国の経済に悪影響を及ぼすため、政府当局は為替介入によって相場を安定させようと画策します。

例えば、為替レートが大きく下落しているならそれ以上は下落しないように買い支え、また大きく上昇しているならそれ以上は上昇しないようにするために、中央銀行は自国通貨を大量に売ったりするのです。

こうして中央銀行が大量の自国通貨を売買することで為替レートを動かすと共に、市場参加者に対して「これ以上為替レートを下げさせない(上げさせない)」という、政府からの強力なメッセージを送る意味合いがあるわけです。

為替介入の仕方にも色々あり、中央銀行が直接取引を行って介入する以外に次のようなものがあります。

- 口先介入:政府首脳や財務省の高官などの金融当局者たちが、為替レートに対する意見や要望などを発言して相場をけん制する。

- 覆面介入:介入を行っていることを公表せずに秘密裏に行う(隠密介入ともいう)。

- 協調介入:複数の国の中央銀行が協力して、同じ通貨に対して為替市場に介入する。

- 委託介入:例えば日本銀行が為替介入を行う場合、夜間や深夜にロンドン市場やアメリカ市場で、他国の中央銀行に代理で介入をしてもらう。

しかし、為替介入によって為替レートを決定的に変えることは極めて難しく、その効果は一時的なものになりがちです。

口先介入とは?

口先介入とは、政府首脳や財務省の高官などが、為替相場の状況に対する発言によって為替レートを意図的に動かそうとすることです。

口先介入は、金融当局者たちが為替レートの水準に対する意見や要望などを、市場参加者に向けてアナウンスする形での介入であり、日本銀行などの中央銀行が実際に為替介入を行なうものではありません。

一般的に口先介入の効果は乏しいですが、国際的な金融危機などで、一国だけでなく複数の国が協調して表明を出す場合は、マーケットへのインパクトが見られます。

それまでの市場コンセンサス(同意の目立つ多数意見)とは反対のコメントが要人の口から飛び出すと、そのサプライズ感によって思わぬ激しい値動きが発生することもあります。

為替市場に対するサプライズな要人コメントは、意図されたものもあれば、不用意に発言したコメントがセンセーショナルにメディアに取り上げられる形で伝わるものもあります。

協調介入とは?

協調介入とは、政府当局による為替介入(莫大な通貨の売買によるレート操作の実力行使)のひとつです。

複数の国の中央銀行が協力して、為替介入対象の通貨に対して為替相場に「大量の売りもしくは買い注文を出すこと」によって介入することをいいます。

ひとつの国の中央銀行だけの介入よりも、その規模が大きく、介入タイミングも介入各国間の時差を利用して幅広く設定できるため、国際為替市場へのインパクトが大きくなる傾向があります。

例えば、日本銀行による日本円への為替介入の場合、EU各国の協力によって日本時間深夜から早朝に、機関投資家などの大口トレーダーたち相場関係者の不意打ちを狙うように行われるケースがあります。

協調介入の実例のひとつとしては、東日本大震災時があった2011年3月のケースがあります。

震災後に日本円に対して仕掛けられた売り浴びせにより、3月17日早朝、ドル円は76円台にまで暴落(円が高騰)したのです。

この急な円高に対して為替介入によるレートの正常化を目論んだ日本政府は、G7に働き掛けて協調介入の合意を取り付けて為替介入を実施します。

その結果、ドル円は81円台にまで値を戻したのでした。

しかし実際にはこのように上手くいくケースばかりではなく、各国の利害や思惑が交錯する結果、足並みがそろわず介入の効果が発揮されないというケースも見られるようです。

委託介入とは?

介入方式には「委託介入」というものがあります。

委託介入とは、為替介入をしようとする中央銀行が、他国の中央銀行に介入を代行してもらうことです。

例えば、日本銀行が為替介入を行う場合だと、夜間や深夜にヨーロッパやアメリカ市場に直接介入できませんから、各国の中央銀行に頼んで介入をしてもらうわけです。

日銀が主に介入を委託する先は、欧州市場ではECB、ロンドン市場ではBOE、ニューヨーク市場ではFEDになります。

反対に日本銀行が、諸外国の銀行の委託を受けて為替介入をする場合もあり、これを「逆委託介入」と呼ぶこともあります。

各国の経済的な思惑を踏まえながら足並みをそろえる必要のある「協調介入」とは異なり、あくまでも為替市場の開場時間に応じた介入の委託だとされています。

とはいえ、そこには各国間の事情が絡んでくることは否めませんので、協調介入の時ほどではないにせよ、我々には知り得ないやり取りや駆け引きがあるのかもしれません。

為替介入の具体例──日本銀行による円売り介入

日本で行われた為替介入の具体例として、2011年の東日本大震災を契機とした投機的な値動きと、それに対抗して行われた為替介入(円売り介入)について見てみましょう。

日本国紙幣は理論的には日本銀行が自ら無限に印刷し発行することが出来ますので、必要なだけ無尽蔵に円を売る為替介入が可能です。

とはいえ、現実的には国際的な非難(自国通貨優遇への批判)は不可避な上、近年では為替介入の効果が限定的、かつ疑問視されていて、表立って行われる機会は少なくなって来ています。

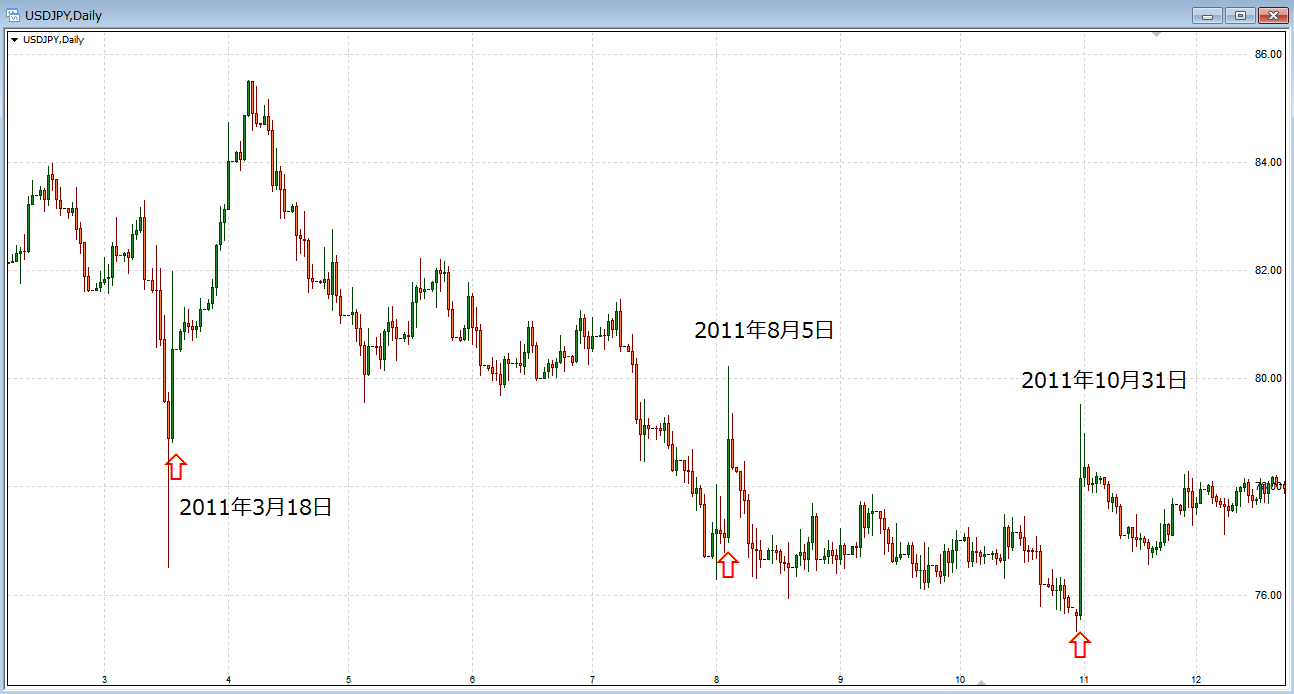

下のチャートはドル円の日足です(チャートをクリックすると拡大します)。

2011年の東日本大震災を受けて投機的な円買いが進んだ状況のなか、日本銀行がおこなった円売り介入の様子がよく分かります。

3月18日には6925億円、8月5日には4兆5129億円、さらに10月31日には、8兆722億円が投じられて「円売りドル買い」の為替介入が行われました。

短期的には円高の動きを押し留めているものの、相場参加者たちのトレンド(思惑やムード)を変えることは出来なかったことが伺えます。

ちなみに、日本政府(日本銀行)による「円売りドル買い介入」は、実質的に見れば、日本の輸出企業に対する補助金という見方ができるため、一部業界(主に自動車産業)への優遇措置であるとして批判されています。

世界各国の為替介入の具体例

では次に、同じ頃に世界中で行われた為替介入について、具体的に見ていきましょう。

アジアや東欧を中心とした新興国は、2011年に至るまで世界中からの豊富な投資マネーによって、順調な発展を見せていました。

そんな中、各新興国は自国の通貨を少しでも安く誘導することで、さらに投資マネーを引き込もうとしました。

自国の通貨が安くなると、他国よりも人件費や製造コストが下がるため、投資先としての魅力が増すからです。

そのため、新興国の間で「通貨安競争」が行われるようになっていったのです。

世界同時株安が発生し、新興国からマネーが逃げ出す

2011年に入ると東日本大震災が起こり、さらには世界同時株安が発生するなど、世界の金融市場は一転して混乱の中へと突入しました。

世界中の投資マネーは、不安に陥ります。

- 「この投資資金を、いったいどこへ向ければいいんだ……?」

- 「少なくとも、リスクのありそうな国からは資金を引き上げよう」

- 「資金の避難先となる通貨(有事の円、金)も不安だから、米ドルに替えておこう……」

そんなネガティブなムードになってくると、世界中の新興国市場へ投資されていた資金が、米ドルに替えられ、逃げだしていく──つまり、新興国の通貨が売られて米ドルが買われることになります。

そうやって、新興国に投資されていた資金が米ドルに集中避難した結果、新興国の通貨が、ドルに対して急落していく(価値が下がっていく)状況になったのです。

各国中央銀行による「自国通貨高」へ向けた為替介入が始まる

さあ、そうなると新興国の通貨当局は、それまでとは180度違った手段に打って出ます。

それまで新興国は、国際競争力を確保するため──つまり人件費や製造コストを有利にするために、自国の通貨を安く誘導する政策(通貨安競争)をとっていました。

しかしその方針を一転させ、今度は自国通貨の急落を防ぐため(自国の通貨を高くするため)、なんと「為替介入の競争」に突入していったのです。

シンプルにいえば、「自国の通貨は安いほうが何かと都合がいい」といっていたのが、一転して「うちの通貨が安過ぎるは困る!」と、言い出したのです。

では、各新興国の為替介入の様子を、実際のチャートでふり返ってみましょう。

シンガポールの銀行による介入

※クリックすると拡大します。

ドル/シンガポール・ドルの日足チャートです。

2011年9月末、一週間だけで4.3%の価値の下落(チャート上では上昇)となっていて、これは過去最大の下げでした。

チャートを見ると、この9月だけで猛烈に上がっていて、当時の投資マネーの引き上げの凄まじさがよく分かります。

9月末~10月初めの為替介入の後、激しく上下しながらも下降していっています。

しかしこれは介入による効果だけではなく、それを受けた相場参加者の過敏な反応と見るのが自然でしょう。

参考リンク アジア通貨動向(23日)=まちまち、韓国はじめ複数の当局がドル売り介入|ロイター

インド準備銀行によるインドルピー相場への為替介入

ドル/インドルピーの日足チャートです。

こちらのインド・ルピーも、2011年9月の投資マネー引き上げが露骨に分かるチャートです。

「為替介入をしても、大きなトレンドを反転させることはできない」ということが、とても納得できるチャートになっています。しかし、これだけの日数をレンジ状態に出来ただけでも凄いことです。

ちなみに、11月に入ってすぐにレンジを下抜けますが、これは典型的な「トレンドと逆方向へのダマシのブレイクアウト」となったケースです。

ロシア中央銀行によるルーブル相場への介入

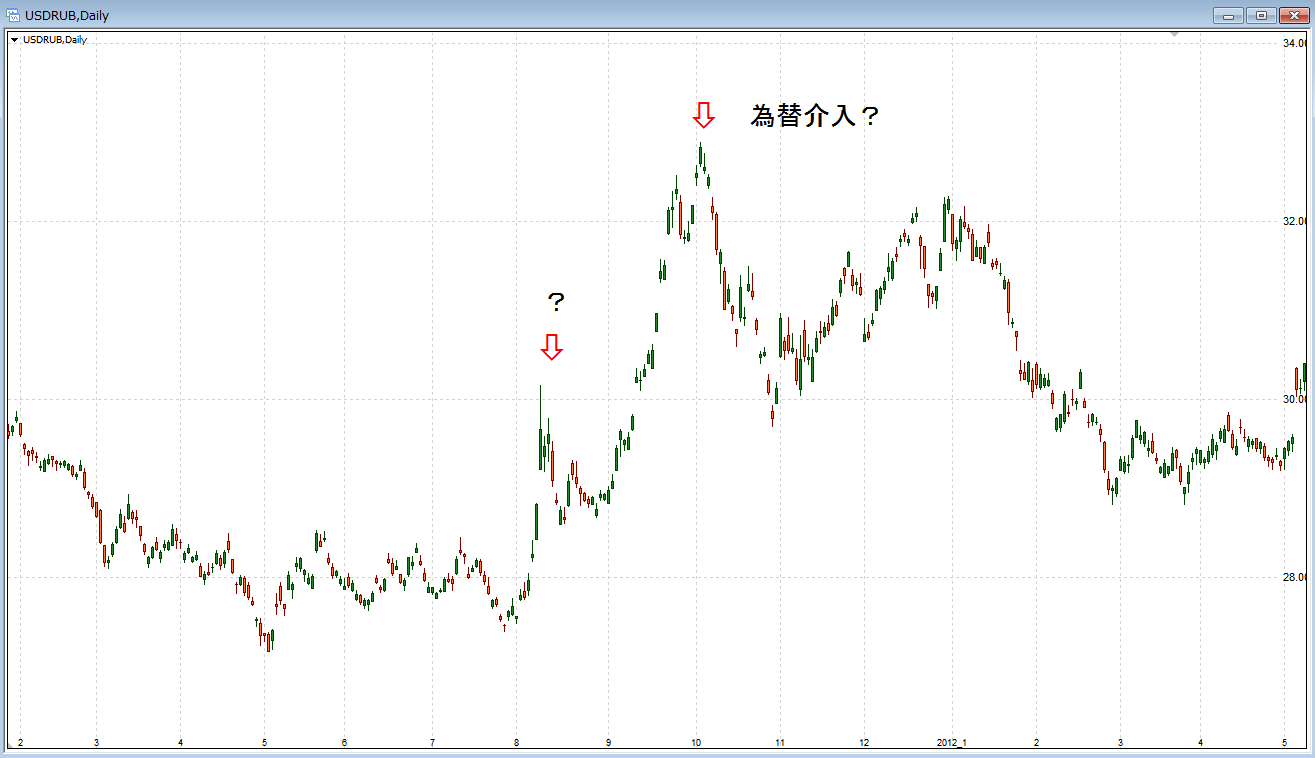

ドル/ルーブルの日足チャートです。

ロシアのルーブルは2011年8月から上昇が始まっていて、この急激なルーブル売りの状況に対して為替介入していた可能性も感じられますが、買いポジションの利食い決済でもこういった動きになりますから、判断が微妙なところです。

そもそも、ロシア中央銀行はいつも、ユーロと米ドルに対して為替介入を繰り返していると見られているため、レートの動きに不自然なケースが目立つといわれています。

9月に入ってからは、ぐんぐん上昇していて、容赦がない投資マネーの引き上げっぷりが見られます。

参考リンク ロシア経済の現状と課題|内閣府

ポーランド中央銀行によるズロチ(ズウォティ)相場への介入

ドル/ズロチ(ズウォティ)の日足チャートです。

もうひとつ、ポーランド中央銀行によるズロチ(ズウォティ)相場への為替介入を見てみましょう。

こちらも、介入のインパクトとみられる、特徴的なローソク足を確認することができます。

ポーランドが為替介入を行ったことがニュースで報じられたときには、すでに韓国や台湾、マレーシア、インドネシアといった国々と、ここまで紹介してきた国々が、自国通貨買いの為替介入を行っていたと見られています。

そんな中で、ポーランドも追随するように介入をおこないました。

参考リンク 新興国が自国通貨安防止の介入競争に―金融市場混乱のドル高受け|wsj.com

ちなみにこの頃、ブラジルでも通貨レアルが、2009年7月15日以来の安値となる1.9500レアルまで急落していて、「ブラジルも為替介入か!?」とニュースになっていました。

参考リンク ブラジル中銀がレアル支援に向け介入、27.5億ドルの通貨スワップ売却|ロイター

やはり為替介入の効果は限定的

こうしてチャートを見てみると分かるように、介入それ自体によって大きくトレンドが変わるということはなく、あくまでも政府・中央銀行からの「市場への強硬なサイン」という趣旨がメインのように思われます。

実際、介入がきっかけとなって「踊り場(停滞)」のような期間が訪れるケースも見られ、それによって相場参加者のムードが大きく変わる可能性もあるものなのです。

そうやって相場の過熱感をある程度冷ますことが出来れば、関係者としては御の字、といったところなのかもしれません。

初めに紹介した日本銀行による2011年の為替介入も同様で、「焼け石に水」と言われながらも3度の円売り介入が行われましたが、その効果はやはり限定的なものでした。

番外編:ジョージ・ソロスvsイングランド銀行

中央銀行による為替介入を取り上げる上で、やはり外せない話題といえば、ヘッジファンドの帝王ジョージ・ソロスと英国イングランド銀行とのマネーバトルです。

ポンドの価値を保ちたい英国政府に対して、「ポンドは実体よりも高くなり過ぎている!」と見抜いたソロスが空前の売りを仕掛けました。その顛末は以下の記事でどうぞ。

中央銀行が引き起こしたマネー大混乱

為替介入には、自国の通貨を買うタイプの介入と、売るタイプの介入があります。

買うタイプの介入を行うためには、自国の通貨を買うための資金が必要です。

例えば、日本円が安くなりすぎて、「円買い介入」をする場合は、円を買うための資金──すなわち米ドルを始めとした他国の通貨が必要です(これを外貨準備といいます)。

ということは、その資金となる米ドルを使い切ってしまうと、もう介入したくても出来ない、という状況になるわけです。

自国通貨を売る為替介入は(理屈上は)無限におこなえる

では、逆に「円売り介入」の場合はどうでしょう?

「円を売って介入する」とは、つまり日本銀行がもっている円を為替市場で米ドルと交換するということです。

なので理屈の上では、日本銀行がじゃんじゃん紙幣を印刷すれば、無限に円売り介入ができるということになります。

実は世界には、実際にこれをやって、自国通貨が一定以上高くならないように介入し続けた国があります。

それが永世中立国スイスです。この継続的な「無限の為替介入」は最終的に市場を大混乱に陥れ、大きな物議を呼ぶことになり、後に『スイスフランショック』と呼ばれるようになります。

詳しくは下の記事で解説していますので、ぜひ読んでみて下さい。

チェコ中央銀行によるコルナ相場への介入

スイス中央銀行による「無限の為替介入」は、大きな悲劇と混乱をまねく結果となりました。しかしその後、世界にはスイスと同じことをした国があります。

それはチェコです。

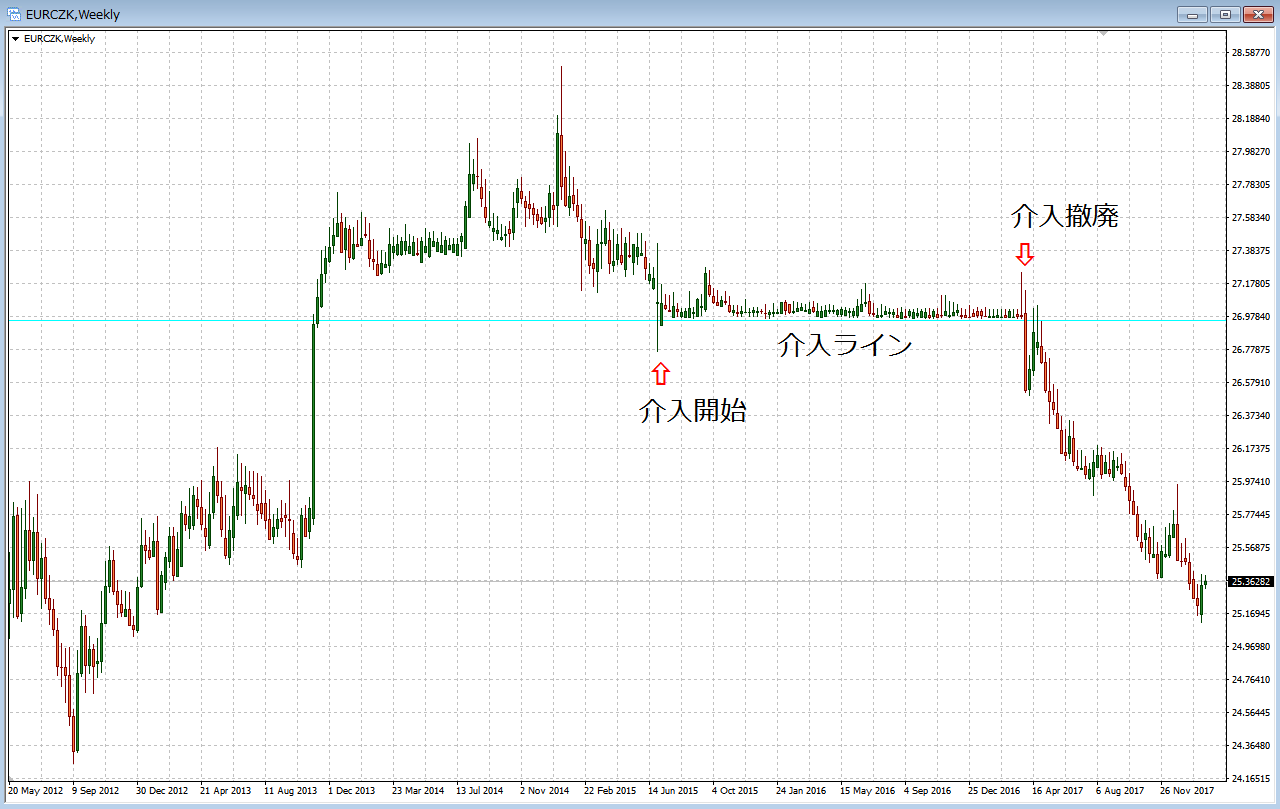

上のチャートは、ユーロ/コルナの週足チャートです。

チェコ中央銀行は、2013年11月7日から「対ユーロへの無限の為替介入」を行ってきましたが、2017年4月6日に撤廃します。

このときは市場でこの決定が予想されていたため、スイスのときのような大混乱にはなりませんでした。

通貨コルナ安によって恩恵を受けていた企業も、為替介入が終了する状況への準備をしていたため、影響は最小限にとどまったようです。

チェコ政府は歴史に学ばなかったのかもしれませんが、市場は大いに学んでいた、ということなのかもしれません。

参考リンク 国立銀行が為替介入を終了、市場は安定して推移-輸出への影響も限定的な見通し-|JETRO

以上、FX専門用語解説『為替介入』とは?分かりやすくチャートで見る「世界の為替介入」について、お伝えしました。

参考リンク

参考情報 為替介入(外国為替市場介入)とは何ですか?|日本銀行

参考情報 為替介入の影響を考えよう!|カブコム証券

参考情報 外国為替介入の定義、戦略、目標(英語)

こちらの記事もおすすめです