Do you know the legendary trader Victor Niederhoffer?

He was such an outstanding trader that George Soros, the king of hedge funds, invited him as a partner and called him “the world’s greatest speculator” for his phenomenal winning streak until 1996.

In this issue of “FX Terminology” series, we will explain terms related to FX, and this time we will talk about a person’s name. We will discuss a rare trader, Victor Niederhoffer, and explain the “lessons of FX” derived from his “riskiness”.

We will also introduce a very interesting financial documentary video featuring Niederhoffer.

Victor Niederhoffer. His Brilliant Career

Niederhoffer was born on December 10, 1943.

His grandfather went bankrupt in the New York stock market crash of 1929. This overlaps with Niederhoffer’s later life and makes him feel inexpressible.

Niederhoffer, a literary and military genius

In every generation, there are always people who are versatile in both academics and sports.

Niederhoffer is literally a man of letters, and he excels especially in sports, having won the student squash championship five times.

In 1962, he was admitted to Harvard University, again on the recommendation of a squash player. He majored in economics at the university and later earned a doctorate from the University of Chicago and even became an associate professor at another university.

At that time, Niederhoffer published a number of papers on the irrationality of markets, the importance of which was recognized by the academic community, and he was highly regarded in the academic world.

At that time, he was considered by those around him to be an “outstanding scholarly teacher,” which is a very different impression from his later flourishing career as a speculator.

Started his market career by establishing a fund

Niederhoffer then gave up his academic career and founded his own investment fund in 1972 and a further asset management consulting firm in 1976.

Between then and 1980, he succeeded in making large profits from the fund, and his achievements finally caught the ear of George Soros.

As might be expected of a man who was later called the world’s best trader, he was already different from ordinary people from the start of his career.

Invited by George Soros, the king of hedge funds

The genius investor George Soros spotted Niederhoffer’s talent.

Soros brought Niederhoffer in as a partner in the fund.

He worked with Soros from 1982 to 1990 and later became head of the fixed income and currency department, where Niederhoffer continued to achieve great results.

He was a man who was determined to do as much as he could to get results, and there was no one to stop him.

Needless to say, Soros thought highly of Niederhoffer at this time, and when he left Soros’ fund, he regretted it, saying, “He was the first person to leave my fund that I did not fire.

Soros even sent his son to work and study at Niederhoffer’s fund, which shows that he had great confidence in his abilities.

For more information on George Soros, please refer to the following articles.

Explanation 『ジョージ・ソロス』とは?ヘッジファンドの帝王のエピソードの数々

Niederhoffer’s fund was doing well itself

Backed by his brilliant career and Soros’s high regard, Niederhoffer’s fund steadily attracted investment funds and achieved high investment performance.

At the time, the fund’s annualized performance was reportedly over 30% per year, an exceptionally high performance for a medium to large fund.

He also achieved a dramatic success in 1994, when the yen appreciated.

In 1994, when the yen was appreciating, Niederhoffer took a huge gamble by betting against the market consensus that the yen would weaken.

This turned out to be a bonanza, and everyone was impressed by Niederhoffer’s sharpness as a gambler.

However, the great success of such a gamble-like trade was also an invitation to the devil to go down a dangerous path.

The time of doom that came to Niederhoffer was the 1997 Asian currency crisis

In 1997, Thailand was enjoying economic growth that was even called the “Asian Miracle” at the time.

However, the country’s economy began to collapse after hedge funds took advantage of the inconsistency in the exchange rate to sell off their shares.

The collapse of the baht, Thailand’s currency, triggered a simultaneous withdrawal of speculative money from all over the world, resulting in the country’s economic collapse and placing it under the control of the IMF (Asian currency crisis).

In the midst of this major event, Niederhoffer was led by the devil down the road to ruin.

Anyway, watch the video below.

You will not be able to take your eyes off the breathtaking dramatic developments and the graphic, exclusive interview with Niederhoffer, the defeated general.

The video begins on October 27, 1997, with the New York Stock Exchange in a state of collapse.

Then the news is reported that “on the day of the big crash, Niederhoffer lost more than $5 billion in one day. ……

Financial documentary program featuring Niederhoffer

How did you like it?

The video was filmed shortly after his bankruptcy, so the blank look in his eyes is quite painful, and gives a sense of the magnitude of the impact of his bankruptcy.

His collection of silverware and old books in his mansion were all taken away as mortgages for additional security, and the traders who had worked for him also left.

I believe that the pain Niederhoffer suffered at that time was not financial, but the denial of his own strength, and more importantly, the denial of his sense of omnipotence.

Still, it is remarkable how gorgeous the people in this video are.

George Soros, Paul Samuelson, Robert Merton, and even that Myron Scholes, famous for his “Black-Scholes Equation” and “LTCM (Long Term Capital Management)” appear.

Why was Niederhoffer ruined?

Let’s recap what Niederhoffer was doing at the time of its demise in the Asian currency crisis.

- He went headlong against the strong downtrend in the Asian stock markets.

- He made a large number of large pickups on his position, which had become a sinking ship.

- He did not hedge risk against his put selling position.

Niederhoffer’s trades during the Asian currency crisis can be characterized as the above.

With all due respect to the man who was called a speculative genius, in this way, I feel the same thing as the so-called “traders who keep losing.

In other words, it is a trade that follows the law of inevitable defeat.

Taking a single shot at a reversal from a trend, doing a lot of pinching, and even not hedging your risk.

In many cases, these actions may temporarily produce results more than worth the courage to continue them.

But it will – and must – come to an end.

And Niederhoffer was no exception.

To make matters worse, on the very day that Niederhoffer’s position was forced to cut his losses, the market rose sharply, just as he had expected.

This is also a famous “there’s a beginner’s Forex market” saying, “The bottom is right there where you sold. At that time, how was he, a super veteran trader, feeling?

*The following links will help you understand the benefits of selling options and their major risks.

Reference オプションの売りで利益を得る

*For more information on the risks of averaging down in trading and how to trade using averaging down tactically, please read the following article.

Explanation What is Forex averaging down? How to understand it and trade tactically

Niederhoffer the Phoenix. And again to tragedy

Niederhoffer once went bankrupt.

But he didn’t stop there.

His talent is real. Whether or not the people around him thought, “He just lacked a little more capital this time,” Niederhoffer was back on the market again, thanks to the help of his supporters.

Niederhoffer himself sold his personal fortune, mortgaged his mansion, and set up another fund with the money he made.

The new fund continued to perform at an astounding average annual rate of over 50% from 2001 to 2006.

The fund’s outstanding performance earned it the “MarHedge Award” in 2006.

Fund disappears in disappointment, caught up in subprime mortgage crisis

But, but also.

The subprime mortgage crisis of 2007 led to a series of withdrawals from Niederhoffer’s fund.

Finally, 75% of the funds were withdrawn, and as a result, his fund disappeared in November 2007.

It seems that Niederhoffer himself was not at fault at that time, and his disappointment must have been great.

Lessons Learned from Niederhoffer’s Trade

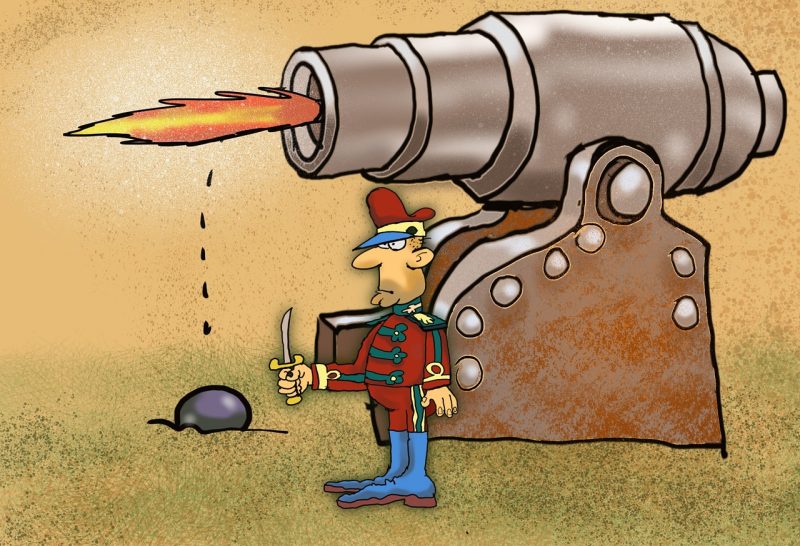

What we see in Niederhoffer’s trades is his excessive courage and the “spirit of taking big risks” that comes from it.

For Niederhoffer, who has been on the road to success from the beginning of his career, this courage may have been a natural driving force.

Unfortunately, however, the courage to withdraw seems to have been a bit lacking.

It is an aspect of trading that one must take big risks in order to make big money, but no matter how big the risk, an exit strategy (withdrawing and cutting losses) must be thoroughly considered.

However, so-called gambler-type traders like Niederhoffer tend to go all out when they see the opportunity to win, as in the case of the Asian currency crisis, and the results are often disappointing.

Gamblers have no idea of winning and running away, and they sometimes assume that it is worthwhile to take big risks and keep on winning. And as long as they continue to play such big games, they are bound to lose eventually.

That is why we should remember to be in awe of the market, keep in mind that anything can happen, manage risk, keep trading, and steadily accumulate profits.

This is an explanation of Victor Niederhoffer and his reckless trading.

We also recommend this article