ナンピンとは、もっているポジションが含み損を抱えているとき、同じ方向へさらにポジションを追加することをいいます。

「ナンピン」という言葉からは、負けトレードをズルズルと引き伸ばしているイメージがありますが、あなたはその本当の姿を理解していますか?

ダメなナンピンと、戦術的に行うナンピン──この違いを理解することで、ナンピンのイメージが変わります。

今回は、『ナンピン』の意味やFXトレードでの効果的な使い方、それにまつわる関連情報をお伝えしていきます。

FXでナンピンすることで得られるもの

FX取引の世界では、ナンピンは「絶対にやっちゃダメ!」なトレードの、その最悪な例のように言われています。

ですから、それを知ったFX初心者は、その全否定ぶりに圧倒されてしまい、そもそも「ナンピンが何を目的としたトレード手法なのか」を知ることすら、避けてしまっているかもしれません。

まず、ナンピンとは?

ナンピンとは、もっているポジションが含み損を抱えているとき、同じ方向へさらにポジションを追加することをいいます。

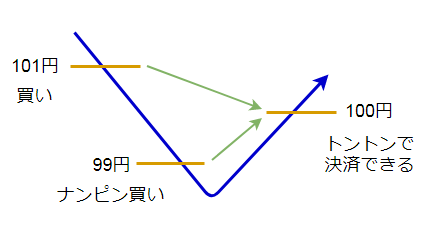

例えば、ドル円の為替レート101円で買いポジションをもちましたが、どんどん下落していったので、99円で「ナンピン買い」をおこないました。

99円で最初のポジションと同じ量の通貨を買った場合、ドル円ポジション合計の平均レートは、「100円」となります((101円+99円)÷2=100円)。

ですので、レートが上昇して100円になったところで決済すれば、101円で買ったポジションも含めて、トントンでトレードを終えることができるのです。

こうやってポジション合計の平均為替レート(平均取得単価・アベレージコスト)を下げていって損切りを先延ばししながら、少しの反転でトントンでの決済をして損失をまぬがれたり、さらには利益を得ようとすること──これを「ナンピン手法」といいます。

ナンピン手法の成功例

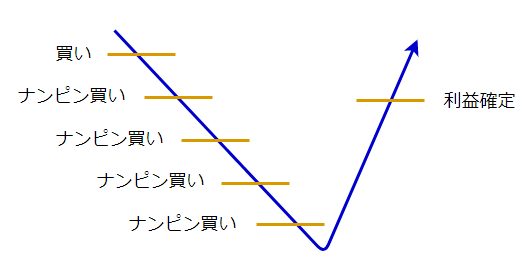

ナンピンがとても上手くいったケースを見てみましょう。

最初の買いエントリーから含み損が続くものの、ナンピン買いを4回くり返しました。

その結果、最初の買いポジションのレートよりも、ずっと低いレートで決済しているのに、なんと利益を得ることに成功しています。

これがナンピン手法による「一発逆転!」の収穫なのです。

一時は含み損を抱えてピンチに陥っていたのが、一転してトントンから含み益へと変わっていくという、その開放感と興奮。

この「レートが戻ってくれさえすれば、トントンもしくは利益確定ができる」という魅力が、含み損のトレーダーの心を甘く誘惑してくるのです。

一見よさそうなナンピン手法にひそむ罠

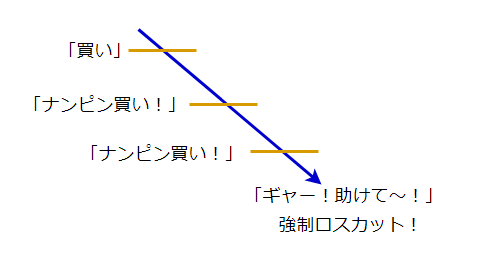

一見すると良さそうに見えるナンピン手法ですが、当然ここには大きなワナがあります。

ナンピン買いを続けても、そのまま下落し続けてしまえば、いずれは維持証拠金不足となって「強制ロスカット」という結果がまっています。

いくらナンピン買いを続けてポジション全体の平均取得単価を下げていったとしても、そもそも反転して為替レートが再び上昇してくれなければ、元も子もありません。

ナンピンをしてレートが建値方向へ戻ってくれればいいですが、そのまま逆行し続けてしまうと、ナンピンによって増えたポジションの分だけ含み損が拡大・倍増してしまいます。

この、反転する見込みのないまま、ひたすらナンピンを重ねていく状況は「無限ナンピン」と呼ばれ、FXの恐ろしいホラーとしてトレーダーを恐れさせています(詳しくは後述)。

この結末の悲惨さと自業自得ともいうべき状況に対して、人々はナンピン手法のことを「愚かなトレード」と呼ぶわけです。

『無限ナンピン』について

無限ナンピンとは、もっているポジションが含み損を抱えているとき、同じ方向へのポジションをさらに持つことを、際限なく何度も繰り返し行うことです。

例えばFX取引で買いポジションをもっていたとき、為替レートが意に反して下落してしまったとします。

ここで再び買いエントリーを行ってポジションを増やすことで、ポジション全体の平均取得レート(アベレージコスト)が現在レートに近づくため、建値撤退でトレードを終えられる可能性が増します。

言い換えると、「現在の負けトレードの可能性を減らすために、さらに資金をリスクにさらす行為」──それがナンピンです。

為替トレードにおいて、計画的かつ戦略的に行われるナンピンは否定されるものではありません。

しかし「負けたくないから」という感情的な理由から行われるナンピンは、FXにおいて危険極まりないものといえます。

無限ナンピンとは、こうしたナンピン行為を際限なく行ってポジションを増やし続けるわけですから、その損失リスクの大きさは計り知れません。

証拠金が底をつき、マージンコールが掛かり、強制ロスカットになってしまえば、文字通りFX口座は破綻してしまい無一文になってしまいます。

そのとき為替チャートを振り返ってみれば、それまでのポジションとは反対方向の明確なトレンドが形成されているのが見て取れ、自分がトレンドに刃向かい続けていたことを知ることになるでしょう。

FXトレードでナンピン手法を戦術的に使う方法

ナンピンで失敗するケースの特徴を知ることによって、ナンピンのメリットである「平均取得単価を有利にすること」を活かせるようになってきます。

とはいえ、これからお伝えすることは、初心者FXトレーダーにはおすすめできません。

今は「こういうエントリーの方法もあるんだな」と、将来のための知識として覚えておく程度にしておいて下さい。

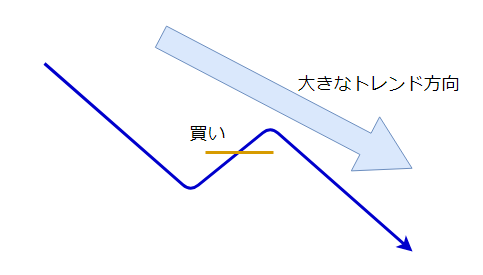

さて、そもそも失敗するナンピンは、大きなトレンドに逆らったままズルズルとポジションを保有し続けることによって生まれます。

であるならば、この反対の状況で、しっかりとした資金管理をした上で計画的なエントリーをすれば、ナンピン手法のメリットを享受できる可能性が出てきます。

「高値づかみをしたくない、でも見逃したくない」という状況

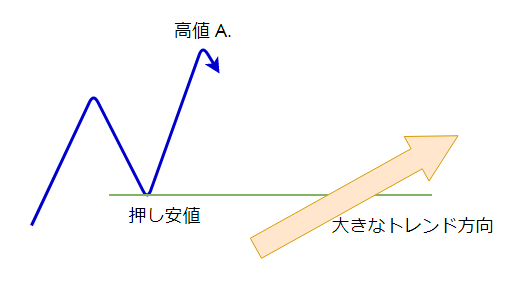

「高値A」の時点で、買いエントリーをしようと考えているとします。

しかし、この「高値A」で買いエントリーをしてしまうと、高値づかみになってしまうリスクがあります(押しの下落の値動きにつかまってしまう)。

かといって、このまま様子見をしていると、そのまま上昇していってチャンスを逃してしまうかもしれません。

さあ、どうしましょう?

こういう状況でナンピン手法を使うと、上手くポジションを持てる可能性が出てきます。

大きな時間足のトレンド方向へ反転していく場面でナンピン手法を使う

現在の相場状況を整理しましょう。

大きな時間足のトレンドは上昇しています。

このチャートでも現在の為替レートは「押し安値」よりも上にありますから、上昇トレンドが継続中であり、目線は「上目線」だと判断できます。

※もしここで「押し安値?」「上目線?」という場合は、以下の記事を参考にしてください。

さて現状では、買いエントリーをするタイミングが悩ましいわけですが、ここで計画的にナンピンを行うことで、結果的にどこで反転~上昇を再開したとしても、買いポジションを持つことが出来るようになります。

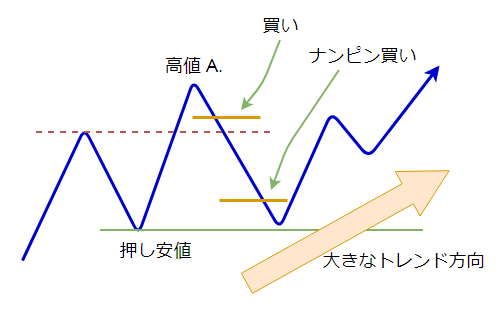

具体的には、前回高値の赤い点線のレジスタンス・ラインがロールリバーサルしてサポートになる可能性を見込んで、まずその高値の上で一回目の買いエントリーをします。

そのライン(ロールリバーサルしたサポートライン)を起点に上昇していったなら、「それで良し」です。

ポジションサイズは本来の一発エントリーよりも小さくなりますが、見送ってチャンスを逃すことは無くなります。

さて、為替レートがこのラインで反転せずに下落を続けた場合、次は押し安値の上でナンピン買いのエントリーをします。

今回のケースでは、ここで押し安値に支持されて再び上昇していき、計画的なナンピン手法が成功しました。

もし、レートが押し安値を下抜けてしまったら、それは想定していた動きにならなかったということで、いさぎよく両方のポジションを損切りします。

※「ロールリバーサル?」「レジスタンス・ライン?」という場合は、以下の記事を参考にしてください。

FXでナンピン手法を有効に機能させるには?

このように、FXでナンピン手法を戦術的に有効利用するためには──

- 大きな時間足のトレンド方向へのエントリーであること。

- サポート・レジスタンスラインを背にした、レートが反転する根拠のあるエントリーポイントであること。

- 計画的な損切りポイントが明確に定められていること。

- ポジションサイズとナンピン回数のリスク管理がルール化されていること。

──これらを徹底することが、とても重要だということです。

これらを無視したナンピン手法は、「ヘタのナンピンすかんぴん」という相場格言通りの悲惨な結果になってしまうでしょう。

下の記事では、一見すると有効に見えるナンピン手法が実はとんでもないリスクをはらんだものであり、その後大きな問題に発展してしまった実在の事件を解説しています。

不安と恐怖から逃げるためのナンピンをしないこと

損切りを先送りするための感情的なナンピンは、いずれ必ず大きな損失となってあなたを苦しめます。

そして取り返しのつかない損失を被って、FXから退場せざるを得なくなってしまいます。

そうなってしまってはFXで利益を得ることは夢のまた夢です。

あの投資の帝王ジョージ・ソロスも、こう言っています──

「まず生き残れ。儲けるのはそれからだ」

生き残るためには、自分のエントリーが想定違いだったことを潔(いさぎよ)く認めて、素直に損切りをすることです。

損切りそのものは敗北ではありません。

しばられていた証拠金を開放し、次のトレードへ向かうための、「資金の自由を取り戻す行為」なのです。そして、クリアになったアタマで改めて次のトレードチャンスを狙えばいいのです。

あまりに大きなポジションで勝負し、さらにナンピンをしてしまったために破産してしまった、ある有名なトレーダーの話がありますので、参考にして下さい。

ナンピンの言葉の由来

ナンピンという言葉は、漢字では「難平」と書きます。「難」は「困難」をあらわし、「平」は「たいらにする」という意味を示しています。

つまり、困難な状況をたいらにする──無事に済ませようとする──ことを表しているのです。

この言葉の歴史は古く、江戸時代の米相場の世界で使われていました。

江戸時代でも、ナンピンをするのは「損失を先送りする愚か者」という意味で使われていて、当時からナンピンのイメージは悪いものだったことがうかがえます。

以上、FX専門用語解説『FXのナンピン』とは?その意味を理解して戦術的にエントリーする方法──について、お伝えしました。

こちらの記事もおすすめです