「FXの検証方法が分からない!」というのは、とてもよく目にするポピュラーかつ深刻な悩みです。

検証ができなければトレード手法を作ることも出来ませんから、FXで勝つことなど夢のまた夢になってしまいます。

今回は、FXの検証方法について、具体的に詳しくアドバイス&解説していきます。

これを読むことで検証のやり方が理解でき、あなたも実際に検証を進めてトレード手法を作ることが出来るようになるはずです。

FXの検証とは? 検証のどこでつまづきやすいのか?

FXの検証とは、過去チャートを分析することによって「繰り返し現れる値動きの傾向(優位性)」を見つけ出し、その優位性を使ってトレード手法を作り上げていく作業のことです。

そのような検証作業を経て出来上がったものが「優位性のあるFX手法」です。

FXの検証のやり方は、大きく分けると次のようなステップになります。

FXの検証のやり方(トレード手法の作り方)

- 過去チャートを大量に収集&分析して、そこに共通する値動き(パターン)を観察する。

- それを元に、トレードルール(手法)の仮説を立てる。

- そのルール(手法)に優位性があるか、検証をして具体的に明らかにする。

- 一定以上の優位性があれば、デモトレードで試してから実戦で用いる。

ちなみに、他の人が作ったトレード手法を使う場合は、3番からスタートすることになります。

さて、FXの検証方法のなかで、多くの人がつまづきやすいポイントは以下の通りです。

- 「トレード手法の仮説を立てること」それ自体に難しさを感じてしまい、まったく手がつけられない。

- 「こうかもしれない」という手法の仮説は立てられても、それに優位性があるか検証する方法が分からず、立ち止まってしまう。

今回は、この二つのポイントについてアドバイスをしていきます。

トレード手法の仮説が立てられない場合のアドバイス

そもそもトレード手法の仮説が立てられないという場合、「優位性があるトレード手法とは、難解で複雑なものなのだ」と、強く思い込んでしまっていて、チャートを素直に(シンプルに)見られなくなっている可能性があります。

例えば、何か複雑で数学的なテクニカル分析をしなければいけないとか、あっと驚くような発見や誰も知らなかったような“隠れた真実”を見つけなければダメだ、といった思い込みを持ってしまっているわけです。

そのため、どれだけチャートを見ても、自分なりの「トレード手法の仮説」を立てられない──そういう状態になってしまっていると考えられます。

「あ、そうか!」と気づく必要がある

「チャートを見ても、優位性なんて簡単に見つかるはずがない」と思い込んでいる人に、いくら「素直にテクニカル分析をすれば簡単に見つかりますよ」といっても、なかなか聞いてもらえませんし、見せても信じてもらえなかったりします。

確かに、実際にFXで勝っているトレーダーは1割ほどで、さらに長期間勝ち続けているトレーダーは極わずかなので、「そんなわけがない」と感じるのは自然だと思います。

ですので、本人が「あ、そうか!」とか「あ、本当だ!」と気づかない限りは、私としてはどうしようもないのです。

人によっては、「本当のこと(秘密の手法などの情報)を教えたくないから、ウソをいってるんだ」と疑われる場合もありますから、何とも難しいものなのです。

こればかりは本人の《心理的な盲点》が外れて、ちゃんと「ありのままの事実」が見えるようになる必要があります。

「トレード手法の仮説」の具体例

そういうわけではありますが、ここでひとつ、検証に値する「トレード手法の仮説」の具体例を見てもらいましょう。

この具体例を見て「はあ!?」と思ってはいけませんよ?

相場の本質は本当にシンプルなのであり、このシンプルさを土台にしていくことで、堅牢で、かつ柔軟なトレード手法ができていくのですから。

例えば、以下のようなものです。

シンプルな「トレード手法の仮説」の例

- 25期間のMA(移動平均線)の先端が上昇している。

- レートがMAよりも上にある。

- (1)と(2)が満たされていれば、買いトレードに優位性があると考えられる。

- この仮説の背景にあるのは、レートが上昇し続けているという事実であり、つまり売り手よりも買い手が多い状態が継続しているという事実である。

文章にしてみれば、「何を当たり前のことを」とか、「そんなもので勝てるはずがない」などと言われてしまいそうなのですが、もう少し話を聞いてください。

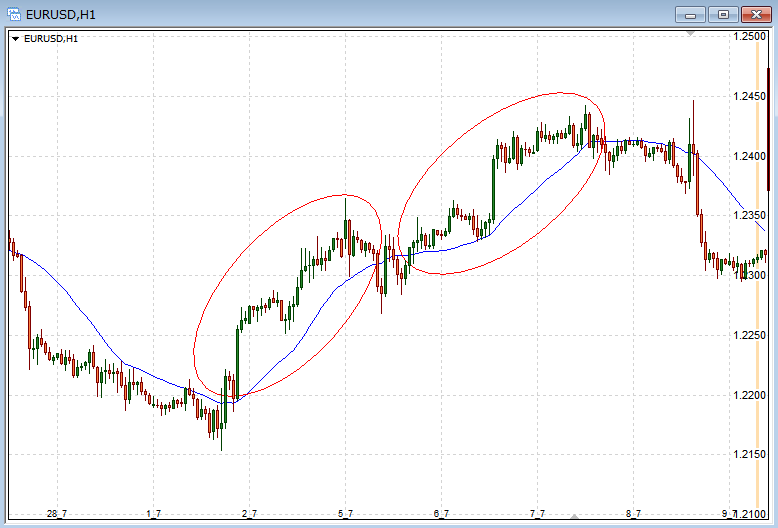

下のチャートはユーロドルの1時間足で、赤い丸で囲った部分が、「買いトレードに優位性がある」と仮説を立てた場所です。

※チャートをクリックすると拡大します。

まずシンプルに素直に見てみるならば、この赤い丸のなかで「買いのトレード」をすれば、勝ちやすいと思いませんか?

この「見たまんまの素直な判断」がとても大事で、相場参加者の集団心理をイメージする上でも、こうして客観的に素直に見られることが、とても有益なスキルになります。

実際に、この赤い丸の左端と右端のレートを比べれば、明らかに上昇しているわけですから、「この中のどこかで買っていれば利益を出しやすい」という、シンプルな結論になるのが分かると思います。

トレード手法の仮説はシンプルなもので大丈夫

このように、チャートを読み取って考える「トレード手法の仮説」とは、基本的に見たままで良く、言われてみれば「そりゃ、そうだよね」というようなもので初めは十分です。

レートが上昇しているのは、売りよりも買いのお金が上回っているからです。

ならばその状態が続く限りは、コバンザメのように買い手についていくことを考えてみればいいのです。

ですから、もしあなたがトレード手法の仮説が立てられない場合は、チャートを素直にテクニカル分析してみて、「こういうチャート状況で買ったら(売ったら)利益を出しやすいんじゃないか?」と思える状況を特定してみて下さい。

その際には、使い慣れたテクニカル指標やチャートパターンの知識を使いながら、そしてシンプルな印象を大切にしながら、手法の仮説を立ててみましょう。

例えば、サポート・レジスタンスラインをつかったり、ダブルトップなどのチャートパターンを使ったり、ダウ理論やプライスアクションを使うなど色々と考えられます。

その際に可能であれば、買い手と売り手、どちらかが心理的に苦しくなると思われる状況やタイミングを想像してみると、効果的で優位性のある仮説が思い付きやすくなると思います。

もし考えた仮説に対して「こんな程度のことに意味がある?」と思っても、最初は大丈夫です。

大切なのは、ここから先の「検証作業」ですから。

FXの検証のやり方が分からない場合のアドバイス

では次に、「こうかもしれない」というトレード手法の仮説は立てられても、その検証方法が分からず立ち止まってしまうケースについて、具体的にアドバイスしていきましょう。

引き続き、先ほどの移動平均線による仮説の例をつかって考えていきます。

トレード手法の仮説を、トレード可能なものにしていく

今のところ、このトレード手法の仮説に本当に優位性があるのか──つまり、トレードを繰り返して利益が出るのかどうかは、まだ分からない状況です。

それにこの段階の仮説だと、検証を進めていくには曖昧さが多いですから、もう少しトレード手法らしい条件を設定してみましょう。

その場合の方法はいろいろありますが、ひとつ有効な方法として考えられるのは、その優位性の仮説を、複数の時間足チャートに重ねて当てはめてみることです。

FXチャートがもつフラクタル構造の性質を考えれば、すぐにイメージできると思いますが、1時間足で仮説を立てた状況のなかでは、5分足チャートでも同じように仮説に当てはまる状況があらわれます。

このように、複数の時間足のチャートに同じ仮説を当てはめてみることで、具体的なトレード手法が見えてきます。

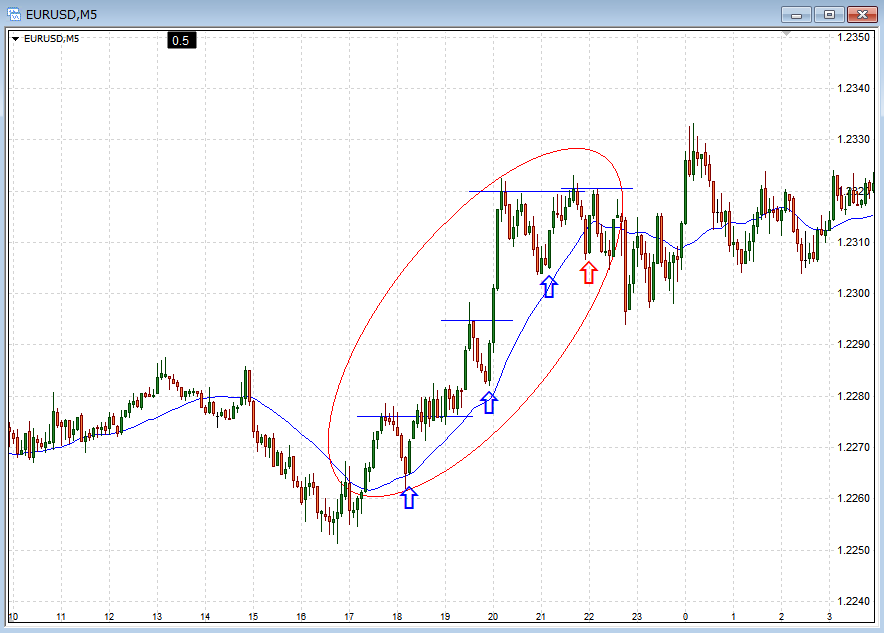

先ほどの1時間足チャートの赤い丸の中を5分足チャートで表示させたのが、下のチャートです。

同じように、仮説に当てはまる場所を赤い丸で囲ってあります。

1時間足で「買いに優位性がある」と仮説を立てている状況のなかで、5分足でも同じ状況になった場所でトレードすれば、利益を出しやすいと考えられませんか?

このとき「チャート同期インジケーター」を使うと、こうした「複数の時間足チャート同士の値動きの関係」を調べるのがとても簡単になります。下の記事では、MT4で利用可能な同期インジケーターを紹介&解説していますので、あなたのMT4にも導入してみて下さい。

ここからは、どんなテクニカル指標でもプライスアクションでもいいので、好みのものを使って、仮のエントリーとエグジット(決済)のルールを決めて手法を整えていきます。

なお、ここは大事なポイントなのですが、私の考え方として、トレード手法で重要なのは「どういう状況(場面)でトレードするか」であって、「エントリーと決済をどうするか」は、その次だと考えています。

ちなみに、トレードする状況を定めたルールを「セットアップ」、エントリーを定めたルールを「トリガー」と呼びますが、まず大切なのはセットアップです。

トレードする状況に優位性があるなら、その優位性を活かす、もしくは邪魔しないエントリーさえしていれば、自然と利益が積み重なっていくものです。

もちろん検証結果を出すためには必ずエントリーと決済のルールが必要です。

そうしないと、そもそも利益と損失があやふやになって検証の再現性が無くなり、他の検証結果との比較検討が不可能になってしまうからです。

大切なアドバイスとして、ここでトレード手法を整えるときには、無闇にこだわり過ぎないようにしてください。あくまでも大切なのはセットアップです。

セットアップとトリガーについての詳しい解説は、下の記事をご覧ください。

エントリーとエグジット(決済)のルールを決める

ということで、今回はMAをつかってトレード手法の仮説を立てているので、同じくMAをつかって、エントリーとエグジット(決済)のルールをざっくりと決めてみましょう。

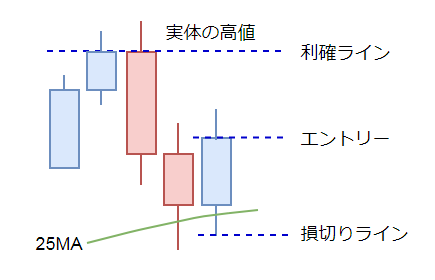

例えば、シンプルなものとして、次のようなエントリー&決済ルールを用意してみました。

エントリーとエグジット(決済)のルール

- MAに近づいたところで陽線が確定したら、終値(次の足の始値)で買いエントリー。

- 損切りは、エントリーした陽線の安値を下抜けたところで行う。

- 利確は、前回の高値(ローソクの実体の高値)で行う。

これは、いわゆる「MAでの押し目買い」と呼ばれる、よくある典型的なエントリー方法です。

決済ルールをシンプルにしておくことが大切

ここで決めておくルールは、先ほども説明したように無闇にこだわらず、基本的にシンプルなものであれば大丈夫ですが、その際におすすめのやり方があります。

それは、損切りラインと利確ラインを、機械的に決められるようにしておくことです。

こうすることで検証中の余計な迷いをなくして、検証作業をスムーズに進められるようになります。

数多くの裁量判断が必要な決済ルールだと、FX初心者が検証を続けていくことは無理だと思います。

最初のうちは、上記のローソク足の高安値ルールのように、機械的に判断できる決済ルールにしておくことがおすすめです。

「トレンドだから伸びていくのに、すぐに利益確定してもったいない!」とか「もう少し粘れば損切を避けられるのに」などと、今は思わなくてもいいのです。

そういう考えが検証中に起こることが、検証を妨げる大きなマイナス要因です。

トレード中のみならず、検証中でもメンタルの負荷を不必要に掛けないように意識してみることが、検証作業を継続していくコツになります。

実際の検証結果を確認する

下のチャートが、このトレード手法でトレードした場合の検証結果です。

青い矢印が利確できたトレード、赤い矢印が損切りになったトレードです(最後のトレードは、ぎりぎりで利確ラインに届かず、損切りになりました)。

青い水平ラインは、前回の高値(ローソク足の実体の高値)です。

エントリーは、MA付近で確定した陽線の「終値」のタイミングでおこない、損切りは「エントリーした陽線の安値を下抜けたところ」でおこないます。

そして利益確定は、前回の高値(ローソク足の実体の高値)まで上昇したところでおこないます。

こうして上のチャートでは、一つの場面で4つのトレードの検証結果が得られたことになります。

青い矢印の陽線の終値から青いラインまでが利益で、赤い矢印の陽線の値幅が損失です。この4回のトレード結果をトータルすると、プラスになっていることが分かります。

これが、検証作業の実際の一例です。

FXの検証中にエントリーの判断に迷ったら?

もしかすると「MA付近で陽線が確定したらエントリーするとしても、どれくらいMAに近づいたらエントリーするの?」と疑問を感じているかもしれませんね?

その答えは「あなたがMAに近づいたと思ったところ」で大丈夫です。そして、ここが検証作業をスムーズに進めていくためのポイントでもあります。

多くの初心者トレーダーにとって検証で大切なことは、誤差のない正確な数字を出すことではありません。

大切なのは、トータルで利益を出せる「優位性のある値動きの傾向」を自分なりに明らかにすることであり、その事実を心の底から納得して受けられるようにすることなのです。

例えば今回の例でいうと、「上昇するMAの上で買えば利益になりやすい」という優位性がある値動きの傾向について、自分の目で「本当にそうだ」と確認して、さらにその事実を心の底から納得して受け入れることが大切です。

そういう深い理解を築いていくからこそ、トレードの実戦のなかで、自分のトレードを確率思考に則って、迷いなく繰り返していけるようになるのです。

3連敗、5連敗したときに頼りになるのは、そうやって自分の中に築かれた「優位性への信頼」です。

なお、先ほど検証用の決済方法を機械的なルールにしておいたのは、こうしたチャート上の値動きの傾向に集中できる心理的な環境を整えておくためでもあります。

そういう訳ですから、最初の段階で細かいエントリー判断にこだわる必要はありませんし、続けていくうちに自然と「自分なりの基準」が生まれてきます。

FXの検証を進めていくことで、「これはMAに近づいてないから見送り」と、普通に判断できるようになりますし、そういう判断力こそが、検証作業のなかで身につく大切なスキルのひとつでもあるのです。

今回の例だと「ここでエントリーするのは無理矢理だな」と思うような位置の陽線は無視しておいて、たくさん同じような状況のチャートを検証していけば大丈夫です。

あなたも相場格言のひとつとして「迷ったらエントリーしない」というものを目にしたことがあると思います。

これは長期的に勝ち続けていくためには重要なポイントなのですが、検証段階からも意識しておくことが大切です。

FXの検証中は、1回のトレードで良い結果を求めない

このトレード手法で検証してみると分かりますが、前回の実体高値までの値幅しか利益にできませんから、とてももったいないトレードが繰り返されると思います。

しかし、そこで考えて欲しいのは、そんなもったいない、ダメな(ように見える)トレードを繰り返していても、トータルではなかなか負けないその事実についてです。

「もったいない利益」のことが気になるのは、目先の1トレードでの結果を求めてしまっているからです。それは、勝つトレーダーの思考法ではありません。

そうではなく、「トータルでどうなのか?」に注目しなければいけません。

まずは機械的なトレードで検証して、しっかりとその検証結果を集めること。その検証結果から、トータルで利益をあげられる優位性があるのかを、自分の目で確認することです。

FXの検証中に新しいアイデアを思いついたら?

さて、こうして検証作業をしていると、「こういう相場状況だと、ここまでレートが到達しやすい傾向があるんじゃないか?」とか、「こういう状況は様子見したほうがムダな負けを減らせるかも?」といった、あなたなりの発見や気付きが出てくるはずです。

この発見や気付きは、お宝アイデアの可能性がありますから、それらの新たなアイデアをつかって、また同じように検証を繰り返していきましょう。

この反復、繰り返しこそがFXの検証作業のミソであり、あなたのトレードスキルが上達していく原動力になるのです。

例えば今回の例だと、5分足のトレンドの勢いが弱かったり、大きな時間軸のサポレジに近い状況だと、損切りが連発することに気づくはずです。

そこでこうした状況を避けるためのアイデアとして、次のようなものを考えることが出来るでしょう。

- 上位時間足のサポレジで反応した押し目ではエントリーしない。

- トレンドの勢いを見るために、上位時間足のMAのパーフェクトオーダーや、ボリンジャーバンドでのレート位置を活用してフィルターを掛ける。

- エントリー時はさらに小さな時間足を見て、安値を切り上げる形になってからエントリーする。

- etc…

検証作業中に新しいアイデアを混ぜないこと

ただ、注意しないといけないのは、まとまった数の検証結果が集まるまでは、今のトレード手法に新しいアイデアを混ぜないことです。

アドバイスとして、今回の例でいうと、5分足チャートでのトレード結果を最低でも50~100個は集めてみてから、そこで気付いたことをルールに加えてみます。

そして、また同じ5分足チャートで検証結果を集めてみるようにするのです。

それらの検証結果を比較してみて、トータルの利益が増えたのかどうか、トレード回数はどれくらい減ったのか、ドローダウンはどの程度か、といったことをチェックします。

いろいろな時期のチャートで検証をする

トレード手法に新しいアイデアを加えて検証することを何度かやってみたら、次にまったく別の時期の1時間足チャートをつかって同じ状況を探し、また5分足チャートでのトレード結果(検証結果)を集めていきます。

こうすることで、新たにルールとして加えたアイデアが、どの程度の優位性があるのか(利益につながるのか)が、はっきりしてきます。

これを何度も繰り返していきます。

こうして、ある程度そのトレード手法が良くなってきたら、次はツールをつかって模擬トレード(FXの練習トレード)をしていくわけですが、それはまた、別の記事で解説することにしましょう。

完璧主義はFXの検証の敵

FXの検証作業で注意しないといけないのは、完璧主義にとらわれてしまうことです。

こうした検証方法によって作業を進めていく中で、ひとたび完璧主義になってしまうと、検証作業の手がピタリ!と止まってしまいます。

「エントリーすべきポイントを見逃してしまっているんじゃないか?」とか、「エントリーの判断が統一できてないんじゃないか?」などと不安を感じてしまい、検証が一歩も進まなくなるのは、「FX検証あるある」のひとつなのです。

しかし、判断にばらつきのある検証結果であっても、たくさん集めていくことで、そのばらつきが一定の平均に収まってきます。

ですから、少々の判断ミスや勘違いがあったとしても、全体としての検証結果の価値が大きく下がってしまうことはありません。

「おおよそこれ位」という検証結果でも、その数が巨大になれば「本当に心の底から、おおよそこれ位なのだ」と信頼が生まれてくるものです。

特に検証を始めた最初の頃は、ひとつひとつの検証を正確にやろうとするよりも、検証結果を多く集めるほうを優先するべきですし、それで十分に統計的な意味のあるデータが得られるのです。

検証方法のイメージがつかめたあなたにおすすめの「優位性とトレード手法」記事

ここまでの内容を理解して検証方法のイメージがつかめたなら、下の「優位性とトレード手法」に関する記事がさらに役立つはずです。

下の記事では、個々の優位性を掘り下げて解説しながら、優位性を活かしたトレード手法の作り方について、さらに具体的に解説しています。

複数の優位性を積み重ねていくことで優位性を強めるやり方や、具体的なトレード手法の解説などを掲載していますので、あなたの手法を作り上げていくために活用して下さい。

FXの検証のやり方~まとめ

チャートを素直にテクニカル分析して考え出す「トレード手法の仮説」は、基本的に見たまんまで良く、言われてみれば「そりゃ、そうだよね」というようなもので先ずは十分です。

“完璧な” 検証結果を求める必要もありません。

FXが確率の世界であるのと同じように、検証も確率で考えればいいのであり、8~9割ほど正しく計測できていれば、データとしては使いものになります。

そのレベルのデータでも、数が増えれば増えるほど、全体としての信頼度が高まってきます。

「おおよそこれ位」な検証結果も、母数が巨大になれば「本当に心の底から、おおよそこれ位だ」という信頼が生まれてきます。

FXの検証で大切なのは、トータルで利益を出せる「優位性のある値動きの傾向」を自分なりに明らかにして、それをトレード手法としてまとめていくことです。

そしてそのトレード手法を、自分の心の底から納得して受けられるようにすることです。

ちょっと検証して、ちょっとデータを出したくらいであれこれ悩むよりも、簡単でシンプルな検証のデータを、何種類も大量に集めてみることに集中するほうが、早くゴールに近づけるはずです。

以上、FXの検証方法教えます。やり方が分からない人は必見「手法の作り方」──について、お伝えしました。

こちらの記事もおすすめです