スイスフランショックとは、2015年1月15日、スイス国立銀行(中央銀行)の政策変更によって引き起こされた、外国為替市場の世界的な大混乱のことです。

今回は、ベテランFXトレーダーなら誰でも知っている「恐怖と戦慄のスイスフランショック」について、それが引き起こされるに至った「実際のトレード」に注目しながら解説していきます。

この記事を読むことで、避けるべき必敗トレードのひとつの姿が見えてくるでしょうし、「相場では何事も起こり得る」という格言の正しさを実感することが出来るはずです。

スイスフランショックに至る経緯

2011年のヨーロッパ各国は、ギリシャの財政問題に端を発した債務危機に苦しんでいました。これを「ユーロ危機(欧州債務危機)」といいます。

そんな中、独自の「スイスフラン」を通貨とするスイスにも影響が及び、景気の悪化やデフレへの懸念が生じ始めていました。

さらに外国為替相場では、こうした不安を背景にした「ユーロ売り&スイスフラン買い」の動きが激しくなり、スイスフランのレートが高くなる流れが止まりませんでした。

スイスフランには安全通貨や避難通貨としての価値があるため、ユーロへの強い不安がスイスフランの買いを呼び込んだのです。

この急激な値動きに危機感をもったスイス国立銀行は、2011年9月6日に「スイスフランのレートを一定以上高くしない」と宣言し、外国為替市場で「無制限のスイスフラン売り」の強硬な為替介入をスタートさせたのです。

スイス中央銀行が行った為替介入の特徴とは?

この「無制限のスイスフラン売り」の為替介入の凄まじさを理解するために、ここで少し為替介入についておさらいしておきます。

為替介入の基本については下の記事で詳しく解説していますので、こちらも参考にしてください。

解説記事 『為替介入』とは?分かりやすくチャートで見る「世界の為替介入」

さて、為替介入には自国の通貨を「買う方式」と「売る方式」の介入があります。「買う方式」の介入を行うためには、自国の通貨を買うための資金(外貨)が必要です。

例えば日本円が安くなり過ぎて「円買い介入」をする場合は、円を買うための資金──すなわち米ドルを始めとした他国の通貨が必要です(これを外貨準備といいます)。

ということは、円買い介入の資金となる米ドルを使い切ってしまうと、もう介入したくても出来ない状況に陥るわけです。

自国通貨を売る為替介入は(理論上は)無限に行える

では逆に「円売り介入」の場合はどうでしょう?

「円を売って介入する」とは、つまり日本銀行がもっている円を為替市場で米ドルと交換することです。

なので理論上は、日本銀行がじゃんじゃん紙幣を印刷すれば、無限に円売り介入が出来ることになります。

スイス中央銀行が行った為替介入はこの方法であり、スイスフランが一定以上高くならないように、ひたすらスイスフランを売り続けたのです。

この継続的な「無限の為替介入」は最終的に外国為替市場を大混乱に陥れ、スイスフランショックと呼ばれる事態を引き起こし、大きな物議を呼ぶことになります。

スイス中央銀行によるスイスフラン相場への為替介入

それではスイス中銀による、当時の実際のスイスフランへの為替介入の様子を、チャートを使って見ていきましょう。

上のチャートはユーロ/スイスフランの週足で、水色のラインがスイス中央銀行の定めた「これ以上は絶対に下げさせないレート」です。

ユーロ/スイスフランが1.2000を下回らないよう(スイスフランが高くならないよう)、スイス中央銀行はひたすらスイスフランを売り続けました。

その介入期間は、2011年9月から2015年1月15日まで、3年以上の長きに及びました。

この3年以上の間、ユーロ/スイスフランのレートが1.2000に近づくと為替介入によってググッと上昇し、またジワジワとスイス中銀の顔色をうかがうようにして1.2000に近づくと、再びググッと上昇する──これを何度も何度も繰り返したのです。

鉄壁のレンジ相場という「聖杯相場」の完成

- 「絶対に1.2000よりも下にはいかない」

- 「なぜなら、スイス政府が無限にスイスフランを用意して売るからだ」

こうした市場コンセンサスによって、スイスフラン相場は絶対に底が抜けないレンジ相場となりました。

それからというもの、1.2000を背にした大量の買い注文が集まっていきます。

なにせ1.2000ギリギリまでナンピン買いを続けていれば、いずれスイス中央銀行が介入してくれて、ユーロ/スイスフランのレートは必ずまた上昇していくことが分かっているのですから。

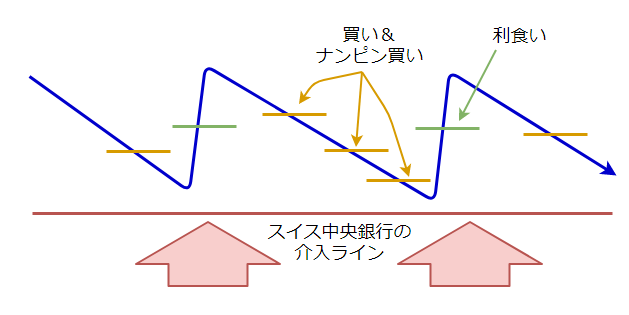

図のように、スイス中央銀行の介入ラインである1.2000を背にしながらナンピン買いを繰り返して、ある程度プラスになったらすぐに利益確定していくレンジトレードが行われたのです。

これはもう、別の意味で「聖杯」とでもいうべきトレード手法です。なにせ「絶対に損切りしなくていいナンピン手法」なのですから。

当時のユーロ/スイスフランの、レンジ状態の時期のチャートをご覧ください。

なかなか介入されなくて、レートが横ばいを続けていたとしても、どんどんナンピンしていれば、平均取得単価は限りなく今のレートに近づいていきます。

そうなれば、ちょっとでも上昇が始まりさえすれば、それだけで利益確定できますし、その状態でもしスイス中銀による為替介入があれば、それこそ大儲けになります。

そこには危険な罠が大きく口をあけて待っていた

しかし、よくチャートを見てください。

レンジとはいえ、ジワジワと下落し続けているのが分かるはずです。

つまり「とても弱いけれど、長期的な下降トレンド」と見ることが出来るのです。

ということは──

- 「いつか上がるに決まってるから、ナンピン買いだ!」

- 「あれ?なかなか上昇しないな……早く介入しないかなぁ……」

- 「でも、上がるに決まってるから、今の内にもっとナンピン買いをしておこう」

──こんな感じで、相場にはどんどん買いポジションが溜まっていくことになります。そしてこれらの買いポジションが、この後のスイスフランショックの引き金になると共に「火薬庫」ともなるのです。

結局このレンジのなかでは、含み損を抱えたまま利益確定ができず、ひたすら上昇を待ち続けているだけの「大量のナンピン買いのポジション」がある、恐ろしい状況が起こっていたと考えられます。

これは、「トレンドに逆らったナンピン」という、必敗のトレードです。

ナンピン手法とそのリスクについては下の記事で解説していますので、参考にしてください。

解説記事 『FXのナンピン』とは?その意味を理解して戦術的にエントリーする方法

この(偽りの)聖杯手法は、スイス中央銀行の「無限の為替介入」があってこそ成り立つものです。しかし実際のレートの動きは、そう上手い具合には動いてくれず、含み損をかかえた「ナンピン買いのポジション」が溜まっていくばかりだったと考えられます。

そして悲劇は、スイス中銀が突然「対ユーロの為替レートの上限を撤廃する(もう介入しない)」と発表したことから始まりました。

スイス中央銀行の為替介入撤廃によって、ついにレンジの底が抜けた!

2015年1月15日、現地時間午前10時30分。「スイス中央銀行は為替介入をやめる」との一報が世界を駆け巡りました。

チャートを見てもらえば分かるように、わずかな時間でユーロ/スイスフランは最大約40%も下落(ユーロに対してスイスフランが急騰)したのです。

まさに「スイスフランショック」と呼ぶべき強烈なショックとなりました。

これは日本円でいえば、1ドル100円だったのが次の瞬間60円になったのと同じインパクトです。

この記事を書いている2018年7月現在、ドル円は110円辺りを巡る動きになっています。

これが突然70円を割り込んだとしたら、どうなるでしょうか。こうなると東日本大震災後の歴史的レートを軽く超える円高状態になってしまいますから、その影響の大きさは想像に余りあります。

実際、スイスでは急激なスイスフラン高の結果、不況すれすれともいえる状況に陥り、観光産業を中心に大打撃を受けたと言われています。

その後は国内の物価高にもつながったため、日常の生活消費が次々に海外へと流れていくなど、こうした影響は長く尾を引くことになったのです。

FXに関係するところでいうと、大手の海外FX業者(アルパリ社)の破綻や、個人投資家の大規模な損失が話題となり、その後しばらくは「FXは危険!」との声が多く聞かれることにもなりました。

そして何よりも、「相場は何事も起こり得る」という実例が、またひとつ加わったのです。

下の参考リンクの記事では、スイスフランショックを経たその後のスイス経済の様子がレポートされています。

参考リンク スイスフラン・ショックから2年 いまだ回復途上のスイス経済|swissinfo.ch

下の動画は、BBC(イギリス国営放送)によるスイスフランショック直後の現地リポートの様子です。

余談~為替介入開始時のインサイダー取引疑惑

スイス中央銀行による為替介入の3週間前にあたる2011年8月、あるインサイダー取引が行われたという疑惑があります。

それは、当時の中央銀行総裁ヒルデブランド氏の妻であるカシュア氏が、事前にスイス中銀の介入情報を手に入れ、その情報をもとにドルを買っていたというものです。

総裁の妻カシュア氏は、介入後のフラン安によって大きな利益(6万フラン=当時のレートで約6万4千ドル)を手に入れたとされ、これが「銀行関係者によるインサイダー取引ではないか」と問題視されたのです。

この疑惑は同年11月に発覚し、カシュア婦人は「ドル相場が過去最安値にあり、ばかばかしいほど安かったためだ」と説明し、自身が金融業界で15年の経験があることと、そのため常に相場状況を注視しているといった趣旨の釈明をしていました。

結果としては、調査では内部規定に抵触するような不正は見当たらず、インサイダー容疑での立件にも至らず有耶無耶になっていったようですが、夫である総裁のヒルデブランド氏は2012年の1月に辞任を余儀なくされています。

個人的には、カシュア婦人の言い分はある程度理解できるものの、「李下に冠を正さず」の故事にあるように、誰が見ても情報リークを疑うことになるのは明らかなのですから、立場的に脇が甘過ぎたといわざるを得ないと思います。

ちなみに、この疑惑の元となったカシュア婦人の取引情報は、サラシン銀行スイスのIT部門担当者がもたらしたものでした。そのため、後にこの従業員は情報漏洩の責任を問われ解雇されています。

スイスフランショック~まとめ

スイスフランショックとは、2011年スイス国立銀行(中央銀行)が開始した「無制限のスイスフラン売り介入」と、その後の為替介入政策の撤廃によって引き起こされた、外国為替市場を中心とした世界的な大混乱のことです。

スイスフランショックは文字通り、世界中に様々なショックをもたらしました。

為替介入が行われていた期間は、「絶対に底が抜けないレンジ相場」という”偽りの聖杯市場”が実現していたため、介入レートを背にした「ユーロ/スイスフランの買いポジション」が大量に溜まっていきました。そこには無謀なナンピンも数多くあったと考えられます。

スイス中央銀行の介入政策撤廃宣言によって、そのレンジの底が抜けてしまい、歴史上例を見ないほどの急激な相場変動が起きてしまい、外国為替市場は大混乱に陥ったのです。

このように相場では何事も起こり得ますし、その前提でリスク管理を行うことが必須なのだと、よく分かる事例といえます。

以上、『スイスフランショック』とは?偽りの聖杯手法に溺れたトレーダーたち──についてお伝えしました。

こちらの記事もおすすめです