今回は、優れたトレード手法を手に入れるためには欠かせない「ある重要な指標」について、詳しく解説していきます。

この指標を知ることで次のようなことが可能になり、あなたの検証のレベルはワンランク上がるはずです。

- 自分のトレード手法に、どれだけ優位性があるのかが数値で分かる。

- 色々なトレード手法の優位性を、客観的に比較検証することが出来る。

- 低リスクで積極的なトレードをするために必要な条件が分かる。

この記事を読んで、これらの知識をしっかり身につけてください。

優位性の評価指標「リライアビリティ・ファクター」

トレード手法にどれだけの優位性があるのかを判断する指標──その名前は「リライアビリティ・ファクター(Reliability factor)」といいます。

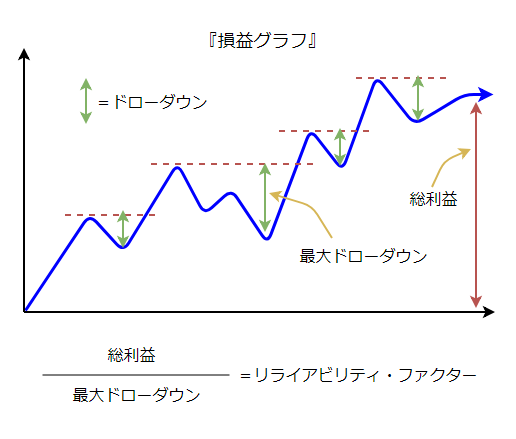

これは、一ヶ月の総利益に対して、最大ドローダウンの値幅が占める割合を示したものです。まずは、下の損益グラフを見てください。

トレードの総利益は、途中でドローダウンを繰り返しながら増えていくものです。

そのドローダウンの大きさと総利益との比率を見ることで、トレード手法が安定的に利益が増えていく手法なのか、それとも変動(落ち込み)が激しい手法なのかが、客観的な数値で分かります。

この数値──リライアビリティ・ファクターを見ることで、そのトレード手法の優位性(この場合は信頼性の高さ)を判断・検証することが出来ます。

リライアビリティ・ファクターの数値が高いほど、そのトレード手法は安定的に利益を上げ続けられると評価できます。

「リライアビリティ Reliability」とは「信頼性・信頼度」という意味で、この指標は文字通り「トレード手法の信頼性」を表すものです。

※ドローダウンのことが分からない場合は、以下の記事で詳しく解説していますので参考にして下さい。

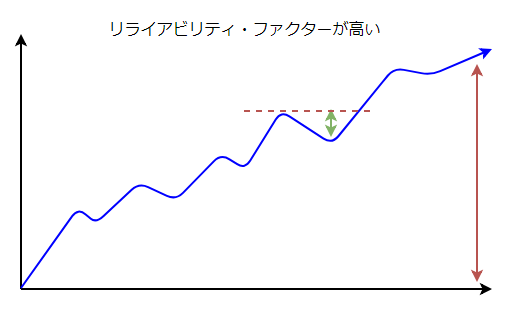

リライアビリティ・ファクターが「高い」ケース

リライアビリティ・ファクターが高い場合の典型的な損益グラフを見てみましょう。

上の図はリライアビリティ・ファクターが高い──つまり一ヶ月間の総利益に比べて最大ドローダウンが小さいケースです。

トレードで損失が出て一時的に証拠金が減少しても、さほど大きな影響はなく、総利益は過去の最大値を更新して再び増加していくため、優位性が高いといえます。

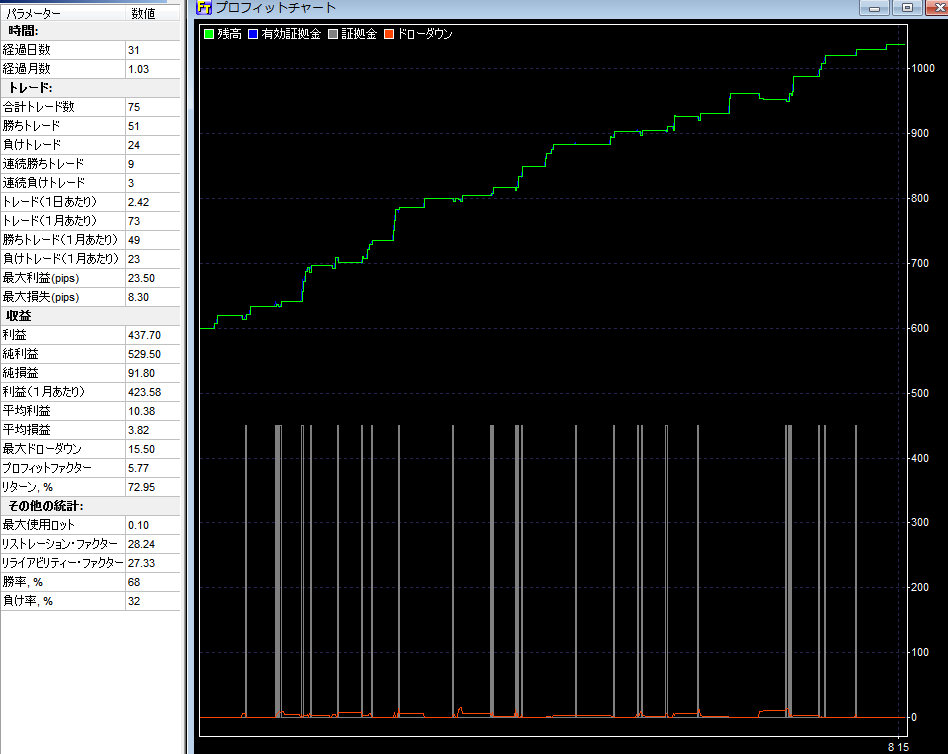

具体例として、私が過去にトレード手法を検証していたときのForexTesterの損益グラフをお見せします。

※クリックすると拡大します。

平均利益と平均損失の比率が2:1程度以上となっていて、スケールの小さな損小利大が成立しています(実質的には損小利小)。

そのため、勝率はさほど高くなく連敗も多くあるものの、一回の損切りは小さく抑えられている結果、最大ドローダウンはとても小さくなっています。

このときの相場状況にも助けられ、リライアビリティ・ファクターは27.33という抜群の数値を出しました。

基本的な姿勢として「小さいリライアビリティ・ファクターを改善する」のが望ましいです。

ここで想像してみて欲しいのですが、FXでこういう損益グラフになるようなトレードを繰り返しているとき、どんな気分になると思いますか?

- 「もし連敗が続いたとしても、またすぐに利益が増え始めるだろう」

- 「とにかく今のトレードルールをしっかり守ってFXを続けていれば、深刻な資金減少にはならずに利益が増えていくに違いない」

──こんな風に、一回の負けトレードや連敗に対する気もちが軽くなりますし、リライアビリティ(信頼性)の言葉の意味通り、自分のトレード手法への「信頼」が感じられるはずです。

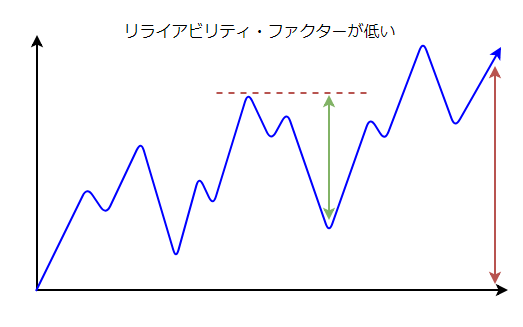

リライアビリティ・ファクターが「低い」ケース

では反対に、リライアビリティ・ファクターが低いケースを見てみましょう。

最大ドローダウンの値幅が一ヶ月間の総利益の半分以上を占めていて、見るからに不安定な損益グラフになっているのが分かります。

これも具体例として、私が過去にトレード手法を検証していたときのForexTester2の損益グラフをお見せします。

※クリックすると拡大します。

全体を見ればトータルで利益が出ていますし、一見すると順調そうな右上がりのグラフです。このトレード手法に一定の優位性があることは疑いありません。

しかし、一ヶ月当たりの利益と最大ドローダウンに注目してみると、その不健全さが分かります(リライアビリティ・ファクターは、わずか1.18しかありません)。

また、ドローダウンを脱するまでに長期間掛かっていたり、脱出してからも利益の伸びが鈍いのが見て取れます。

先ほどと同じように、FXでこういう損益グラフになるようなトレードを繰り返しているときの気分を想像してみてください。

- 「今度連敗が始まったら、もうそのまま勝てなくなるのでは?」

- 「いくら利益を積み重ねても、またそれを吐き出してしまうだろう……」

- 「何だか、骨折り損のくたびれ儲けだ」

──こんな気もちに覆われる結果、いくらトータルでは勝てる優位性のあるトレード手法だとしても、その手法を使い続けることに困難を覚えるでしょう。

つまり「トレード手法を信頼できない状態」になってしまうのです。

どれくらいの数値が望ましいのか?

リライアビリティ・ファクターの数値がどの程度以上あればいいのかは、対象期間をはじめとした要素によるので一概にはいえません。

しかし一応のガイドラインとして、私は以下のような目安が有効だと考えていますので、参考にしてください。

リライアビリティ・ファクターのガイドライン

- 2.0未満だと、優位性があって利益は出ていたとしても、FXトレードを継続していくことにメンタル的な困難を感じる可能性がある。

- 少々のトラブルを乗り越えてトータルプラスを維持していくためには、リライアビリティ・ファクターは3.0以上は必要。

- 5.0~8.0程度あれば、優位性を実感しながら安定的にトレードを継続でき、利益を上げていくことが可能。

- 10.0以上あれば、大きなポジションサイズでの積極的なトレードや、複利運用も十分可能になってくる。

トレード回数が少ないと正確な数値が出ませんし、期間が長すぎると大きな数値が出やすくなるためです。

リライアビリティ・ファクターが高いことのメリット

リライアビリティ・ファクターが高いトレード手法には、以下のようなメリットがあります。

- 少々の連敗が起こったとしても、優位性に疑いを持たずに、心理的に安定してFXトレードを続けていくことが出来る。

- ポジションサイズを大きくしてトレードすることが出来るので、資金効率が上がる(利益が増えるスピードが上がる)。

「1」の心理面でのメリットは、先程解説した通り、ドローダウンの影響が総利益に比べて小さいため「一回の負けトレードや連敗に対する気もちが軽くなる(プレッシャーが低くなる)」というものです。

次に「2」のメリットについて詳しく説明していきましょう。

利益を増やすスピードを上げられる

リライアビリティ・ファクターが高いと、ポジションサイズを大きくすることが出来る──これはどういう意味でしょうか?

例えば、ポジションサイズを普段の2倍にすると、損切りしたときの損失額も当然2倍になります。

つまり、ポジションサイズを大きくすると、それだけ資金が減るスピードも上がってしまいます。

だからFXでは、一回の損失額を証拠金の1~2%までにする資金管理ルールによって、大きなポジションによる過剰なリスクを避けるようにします。

しかしリライアビリティ・ファクターが高いトレード手法をもっているのなら、大きなポジションサイズによる積極的なトレードが可能になってきます。

期間当たりの総利益に対して最大ドローダウンが小さいということは、連敗や思わぬ損失が生じても証拠金に及ぼす影響が小さいわけです。

ですからその分、1回あたりのトレードのリスクを増やせる余地があるのです。

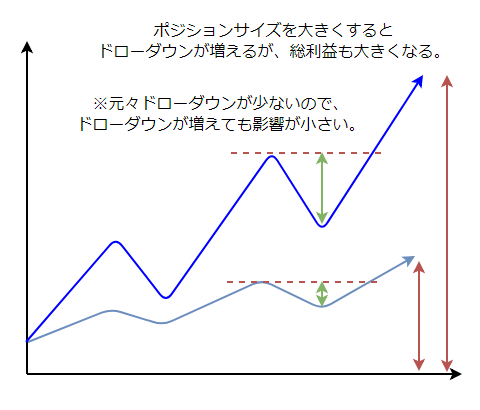

このことを表したものが下の図です。

薄い青色のグラフが、リライアビリティ・ファクターが高いトレード手法の損益グラフで、青色のグラフは、その同じトレード手法でポジションサイズを増やしてトレードを行った場合の損益グラフです。

ドローダウンの絶対量は増えていますが、証拠金が破綻することなく大きく増加していく様子が分かります。

この「ドローダウンの絶対量は増える」という点には、大きな注意が必要なのは言うまでもありません。

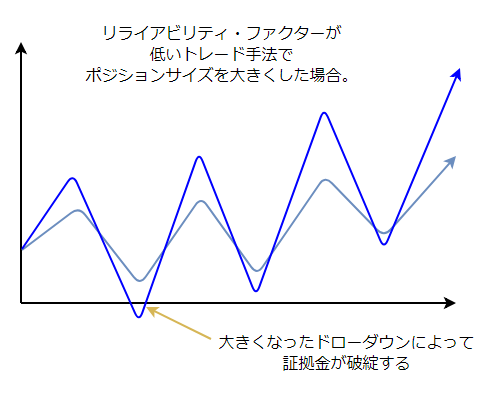

そこで、ドローダウンの絶対値が増えるリスクについて実感してもらうために、リライアビリティ・ファクターの低いトレード手法でポジションサイズを増やして、利益を増やすスピードを上げようとした場合を見てみましょう。

薄い青色のグラフが、リライアビリティ・ファクターが低いトレードの損益グラフで、青色のグラフは、ポジションサイズを増やして同じトレードを行った場合のグラフです。

確かに最終的には総利益が大きくなっていますが、その途中で証拠金がマイナスになってしまって破綻しています。

これは、大きくしたポジションサイズによって、ドローダウン時の累積損失が倍増してしまった結果です。

もし証拠金が破綻しなかったとしても、大きくドローダウンした状況では証拠金維持率の不足から、本来のポジションサイズよりも小さなポジションでしかエントリーできなくなります。

証拠金不足に陥った結果ポジションサイズが小さくなると、利益額が小さくなるためドローダウンからの回復には通常の何倍ものトレード回数が必要になってしまいます。

FXにおいて、トレード手法に優位性があるからといって安易にポジションサイズを大きくすることのリスクが、この図を通してよく分かると思います。

それと同時に、リライアビリティ・ファクターの高さがもたらすメリットが理解できると思います。

FXの検証でリライアビリティ・ファクターを使う利点

リライアビリティ・ファクターを使うと、トレード手法の優位性を客観的に評価できるため、次のような利点があります。

リライアビリティ・ファクターを検証で使うメリット

- トレード手法の改善(調整)を永遠に続けてしまうことを避けられる。

- 「もっと良い手法があるのでは?」といって聖杯探しで迷走しなくなる。

「今よりももっと良いトレード手法に改善しよう」とするのは基本的に正しい取り組みです。

しかし、明確な評価指標がないままルールの調整を続けても、ゴールのない競走のようなもので、いつまでもトレード手法をいじり続けてしまうことになります。

手法いじりが過ぎて本来の優位性を損なってしまい、「結局は最初のままが良かったんじゃないか?」という結果にもなりかねません。

それに、トレードルールを調整すること自体が目的になって、時間ばかりが過ぎていく状態に陥る可能性もあります。

リライアビリティ・ファクターを使えば、そんなトレード手法調整(聖杯探し)の迷宮に迷い込むことを避けられます。

リライアビリティ・ファクターは、あらゆるトレード手法の優位性を1つの指標で評価することが可能になる便利な指標です。

もちろん万能ではありませんが、トレードで継続的に利益を上げる目的を果たすための、とても有益な指標であることは間違いありません。

トレード手法の改善(調整)に使う場合

FXでトレード手法を調整して結果を改善しようとする場合は、調整前のリライアビリティ・ファクターと調整後を比べて、数値がどう変化したかに注目します。

調整の結果、トレード回数が増えてトータル利益(獲得pips)も増えたとしても、リライアビリティ・ファクターが大きく低下したなら、それは好ましい調整ではなかった可能性があります。

それは例えば、「利益になり難い相場状況でも無理にエントリーする」というルールに変わった結果として、トータル回数と総利益が増えたと考えられるからです。

そのためトレードルールが噛み合わない時期が訪れると、調整前のルールよりもドローダウンが大きくなってしまう可能性が高いです。

さらには、下手をすると時期によっては優位性が消失してしまう可能性もあります。

トレード手法の改善において好ましいのは、トータル利益が減ったとしてもリライアビリティ・ファクターは高くなるような調整です。

この調整後のルールでポジションサイズを増やしてトレードすれば、以前のトレードルールよりも安定して利益を上げられるようになります。

トレード手法の比較検証に使う場合

FXで様々なトレード手法を比較検証するとき、一般的には各トレード手法の一ヶ月当たりの獲得利益(獲得pips)を使って比較するケースが多いですが、これには問題があります。

極端な例でいうと──

- レバレッジの限界まで大きなポジションをもって、

- 損切り幅を大きくして粘り続けて、

- トレンドに運良く乗ることで利益を得る。

こういうトレード手法でも、見かけ上の獲得利益は大きなものになります。

しかし実際には大きな損切りが避けられないためドローダウンは大きくなる傾向がありますし、ポジションが大きいことも影響して証拠金が常に過大なリスクにさらされます。

ですから長期的に見れば、実はこれは優位性が乏しいトレード手法である可能性があります。

反対に以下のような、一見しょぼいトレード手法がリライアビリティ・ファクター的には強力だったりします。

- 数少ないトレードチャンスを見極め、

- 小さな損切りと、さほど大きくない(小さ目の)利益確定を繰り返す。

こうしたトレード手法では、期間当たりの獲得pipsは小さくなる傾向があります。

しかしリライアビリティ・ファクターは高く、そのため低リスクでポジションサイズを増やせるため、獲得できる金額は大きくなる傾向があるのです。

こうしてトレード手法の優位性を比較検討できるのも、リライアビリティ・ファクターという指標があればこそです。

ForexTester5だと統計画面に表示される

今回解説したリライアビリティ・ファクターは、ForexTester5では標準で統計画面に表示されます。

ですから、FXのトレード練習で常に統計結果を観察して、トレード手法の信頼性をチェックすることが出来ます。

トレード手法の比較検討にも重宝しますので、ForexTester5を活用することをおすすめします。

ForexTester5では、2種類の優位性(信頼性)指標が利用可能です。

- リライアビリティ・ファクター(Reliability factor)「一ヶ月当たりの数値」

- リストレーション・ファクター(Restoration factor)「全検証期間の数値」

特にリライアビリティ・ファクターは、検証期間が一ヶ月未満だった場合でも、その時点での統計をもとに「一ヶ月の想定利益」を算出した上で指標を出してくれます。

ですから、トレード回数の多いルールを使うときには、1週間のトレード結果からでも正確なリライアビリティ・ファクターが出せるので、比較や調整がとてもしやすくなります。

ForexTester5については、以下の記事を参考にして下さい。

関連記事 定番&おすすめのFX練習ソフト『フォレックステスター』

トレード手法の優位性を評価検証する方法~まとめ

トレード手法の優位性を評価検証する指標として、「一ヶ月間の総利益」を「最大ドローダウン」で割った数値が役に立ちます。

これをリライアビリティ・ファクター(もしくはリストレーション・ファクター)といいます。

リライアビリティ・ファクターの数値が高いほど、そのトレード手法は安定的に利益を上げ続けられると評価できます。

複数のトレード手法を比較検討するときや、トレード手法を調整・向上させていくときの判断指標として、とても有効です。

リライアビリティ・ファクターを把握することで、1トレードごとのポジションサイズを低リスクで最大化していけますので、資金効率が高まります。

以上、トレード手法の優位性の検証方法とは?FXの重要指標を教えます──についてお伝えしました。

こちらの記事もおすすめです