ドテン(途転)とは、今まで持っていたポジションを利益確定もしくは損切りした直後に、反対方向のポジションを持ち直す(再エントリーする)ことです。

買いのポジションを持っていた場合、決済の直後に売りエントリーを行います。

これを「ドテン(途転)売り」といい、ドテン買いの場合はこの反対になります。

ドテンに伴う「直前のポジション決済」には、利益確定による決済と損切りによる決済の二つのケースがあります。

理想は「利益確定からのドテン(途転)」だが難易度は高い

誰もが理想に描くドテン(途転)は、それまでのポジションを利益確定した上でドテンエントリーし、そのドテンのポジションも利益確定で終わるトレードでしょう。

このような「売りと買いの往復で利益確定するトレード」は、基本的にはレンジ相場で実践しやすいとされています。

しかしこれは非常に難易度が高いトレードであり、FX初心者が安易に手を出すと「往復ビンタ」を食らってひどい目にあう可能性が大きいですので、おすすめしません。

また他に、ドテントレードとしてよく例に上がるのは、自分のポジションがオーバーシュートの値動きに乗ったことを確認後、利益確定してドテンするケースです。

これはオーバーシュートの値動きが、行き過ぎからの調整(反転・戻し)になる場面で反対方向への波に乗るというトレードになります。

これも難易度が高くリスキーなトレードであり、プライスアクションの見極めが甘かったり誤ったりすると、それまでのオーバーシュートの強い勢いによって猛烈な勢いで含み損を増やす結果になってしまいます。

損切り後のドテン(途転)には注意が必要

損切り後のドテンの場合は、多くのケースでそれまでの相場判断を180度反転させて行う傾向があるため、心理的な抵抗が大きくなりがちです。

多くのFXトレーダーにとって、ドテンが手法としてルール化されていても「本当に逆方向へエントリーしても大丈夫なのか?」という不安が先立つのがドテンというものです。

ましてやルール化されていない場当たり的な感情エントリーであれば尚更、ドテンは困難を伴うトレードになることでしょう。

多くのFXトレーダーは「上じゃないなら下だろう」という安易な感情的判断によって「損切りからのドテンエントリー」を行いがちです。

ドテンは、初心者FXトレーダーはもとより、多くのトレーダーにとって大きな注意が必要なエントリー手法だといえます。

FXでドテン(途転)が使われる場面とは?

ドテン(途転)の具体的な例をいくつか挙げながら、ドテンについて解説を進めていきます。

以下、「損切り後にドテンするケース」と「利益確定後にドテンするケース」の両方を紹介します。

レンジ内に戻る方向へのポジションを損切り後にドテンするケース

レンジ相場のレンジ上下限付近にレートが到達している相場状況が、ドテンを使う典型的な場面です。

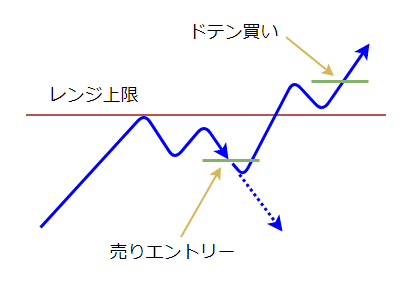

下の図は、レンジ上限のレジスタンスラインにおける「売りエントリー~損切り~ドテン買い」の一連の流れを示したものです。

ここでは当初、レジスタンスラインでレートが反転し、再びレンジ内に戻っていく値動きの流れに乗るシナリオを想定していました。

そこで先ず、レンジ上限となるレジスタンスライン付近で売りポジションを持ちました。

想定通りレンジ上限から反転してレートが下降してきたならば、そのまま目標ラインまでホールドして利益確定することになります。

しかし、ここでレジスタンスラインを上方へブレイクアウトしたならば、そのままレートが上昇していく可能性が出てきます。

そこで「レンジ上限を確かにブレイクした」と判断できたタイミングでドテン(途転)買いを行います。

つまり、売りポジションを決済して小さく損切りした後、すぐに買いエントリーをするのです。

上の図の場合、ドテン買いのタイミングの直前で売りポジションを損切りします。

レンジ上限を抜けて出来た高値をさらに更新したタイミングなので、この時点で「レンジ上限を確かにブレイクした」と判断できますから、本来のブレイクアウトでの買いエントリーポイントとしても妥当なタイミングといえます。

この「損切りからのドテン買い」は、事前にトレード手法として組み込まれているべきものであり、決してその場の雰囲気や感情に流されて行うものではありません。

「下じゃないなら上だろ!」といって感情的に安易なドテン売買を行うのは、既述の通り「往復ビンタ」を呼び込む結果になってしまう可能性があります。

オーバーシュートの流れに乗った状況で利益確定後にドテンするケース

このケースのドテンは、経験豊富な裁量トレードによって度々おこなわれるドテントレードのひとつです。

安易に真似をすることは厳禁ですが、一例として紹介しておきます。

オーバーシュートとは、為替レートが急激に上昇方向へ動いて「行き過ぎた値動き」を見せることです。

解説記事 『オーバーシュート』の意味とトレード手法のアイデア

オーバーシュートの背景には、それまでのレンジをブレイクアウトしたことによる「大口の損切りと新規の買い注文の殺到(パニック買い)」や、突発的かつ膨大な「実需の買い注文」が発生したことなどが考えられますが、正確な理由は分かりません。

多くのケースでは、オーバーシュートの途中で勢いよく下落を始め、その後は乱高下の様相を呈したり、一気に下落を続けてオーバーシュート前のレートまで戻ってしまう、いわゆる「全戻し」になったりする傾向が見られます。

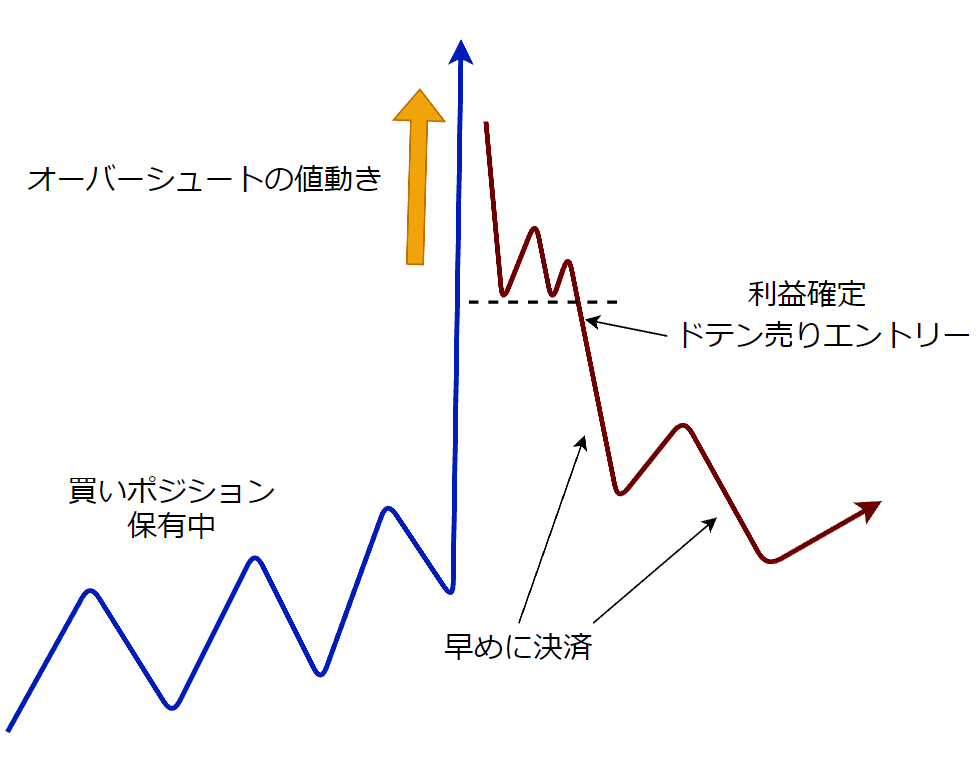

さて、下の図は、上位時間足のトレンド方向に沿った買いポジションを保有中、オーバーシュートが発生した状況でのドテン売りの流れを示しています。

明らかに急激かつ極端な上昇である「オーバーシュート」は、為替介入による一方的な上昇を除いて、有意な確率で「大きく反転し始める(乱高下する)」か、もしくは「その場で停滞し始める」という傾向が見られます。

そこで、一旦大きく反転下降し始めた場合、再度勢いよく上昇することを否定するプライスアクションやチャートパターンが現れた時点で利益確定します。

上の図では、オーバーシュートの最高値から急激に反転して一度は下げ止まった(局所的な小さなレンジを形成した)ものの、下げ止まりの安値ラインを下抜けたため、ドテン売りをした──という状況を示しています。

このドテン売りのポジションはこの後、乱高下に巻き込まれる確率が高いため、ホールドを粘るという選択肢は無く、直近のラインやプライスアクションなどで早々に利益確定することになります。

それに、再び勢いよく上昇していく可能性もあるため、損切りを躊躇うことは厳禁です。

そもそも今回の状況下での売りポジションは、上位時間足のトレンド方向に逆らった逆張りトレードになっているため、ホールド時間が長引けば長引くほど不利だということを忘れてはいけません。

以上が、元々の買いポジションを利益確定した直後にドテン売りエントリーをする一例です。

繰り返しますが、このドテントレードは豊富な裁量トレードの経験と過去チャート検証が必要なものですので、安易に実践せず、しっかりとあなたの手で検証して下さい。

優位性のある「ドテンを活かしたFXトレード手法」

ここからは、実際に優位性のあるドテンのFXトレード手法を具体的に紹介しながら、さらに詳しくドテンについて解説していきます。

「優位性の高いエントリー」が損切りになった相場状況でのドテン(途転)が効果的

まず大きな前提として押さえておきたいのは、いくつもの優位性を積み重ねて見極められたエントリーが損切りになってしまった相場状況こそ、ドテンの効果が発揮される場面となり得る──ということです。

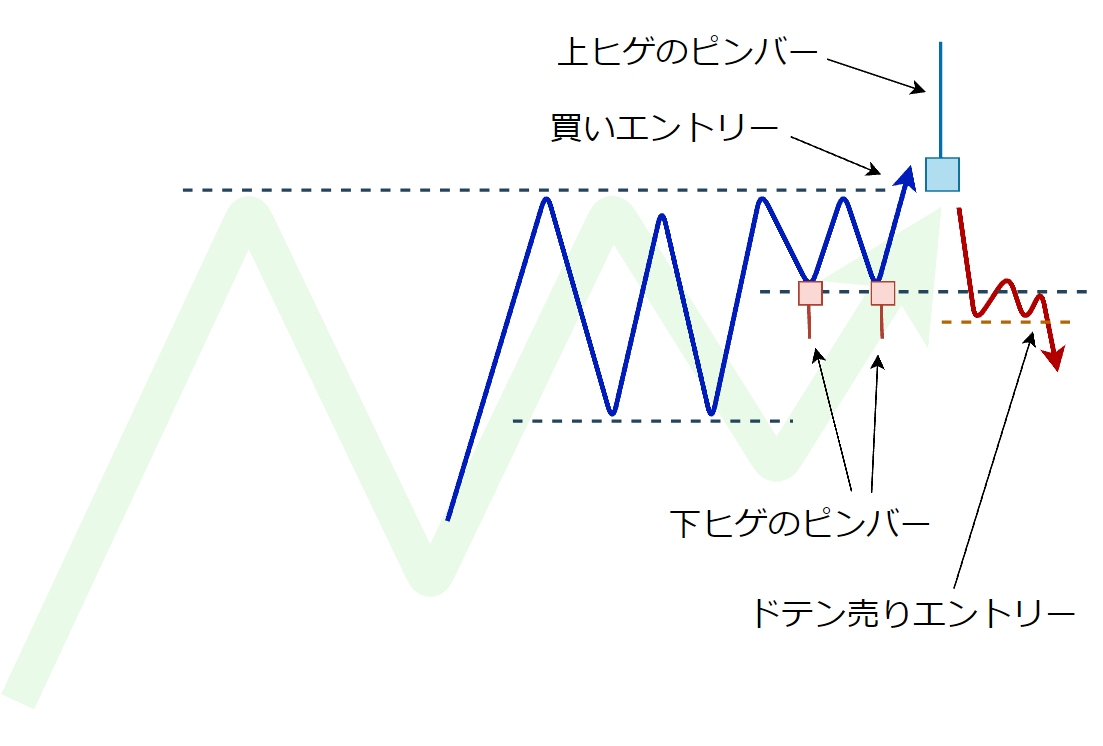

下の図では、レンジ上限をブレイクアウトしたタイミングで「買いエントリー」をした状況を示しています。

この買いエントリーでは、以下の様な優位性が組み合わされています。

- 上位時間足は、上昇トレンドから三角保ち合いのレンジになった状況(薄いグリーンの矢印の値動き)。

- トレードする時間足(執行時間軸)では、上位時間足のレンジ上限付近で長期間レンジ状態になっている。

- 直近では下ヒゲの長いローソク足(ピンバー)が何本も現れ、下降ブレイクアウトが失敗している(ダマシが頻発している)。

- 執行時間軸チャートのレンジ上限付近でさらに小さなレンジが形成され、その上限を勢いよくブレイクアウトした。

このような相場状況であれば、買いエントリーはいくつもの優位性に裏付けられた妥当性の高いエントリーだと言えます。

勢いよくレンジ上限をブレイクアウトしていくタイミングでエントリーした買いポジションでしたが、残念ながらエントリーしたローソク足が長い上ヒゲ(ピンバー)となってしまい、あっけなく元のレンジにレートが戻ってしまいます。

この後の値動きは以下のようになりました。

- 買いエントリーした直後のローソク足は、長い上ヒゲを形成した。

- そのまま執行時間軸のレンジ上限付近の小さなレンジ下限を下抜けた(ブレイクアウトした)。

- 小さなレンジ下限をブレイクアウトしても、戻し(然るべき反転上昇の値動き)が見られず、買いの勢いが弱い。

これらの値動きは、単体もしくは三つの値動き全体で見ても、通常であればこれだけで売りエントリーの根拠とするには弱いものです。

しかし、これが「高い優位性に裏付けられた買いエントリー」が否定された状況下で起きている点に、その意味と価値があります。

買いエントリーに高い優位性があった状況が否定されたということは、それだけ強力な売り勢力が存在している証拠となります。

そしてその後の値動きは、その証拠をさらに補強するものです。

以上の理由から、ここで損切り決済してドテン売りエントリーを執行することは、優位性を味方につけた有力で効果的なトレードであると考えられます。

過去チャート検証とトレード練習を積み重ねた高度な裁量トレードにおいては、こうしたドテン(途転)エントリーが手法として組み込まれているケースが多いものです。

これを参考に、あなたも優位性のあるドテンエントリーを手法化してみてはいかがでしょうか。

その際には「セットアップとトリガー」という手法の組み立て方を理解しておくと、過去チャート検証やトレード練習を進めやすくなるでしょう。

解説記事 『セットアップ』とは?その意味とFXトレード手法の重要部品の作り方

ドテン(途転)で注意すべき「往復ビンタ」とは?

往復ビンタとは、保有していたポジションが損切りになった直後に、改めて反対側へエントリーしたものの、そのポジションも損切りになってしまうことをいいます。

いわゆる「泣きっ面に蜂」といわれる状況のことです。

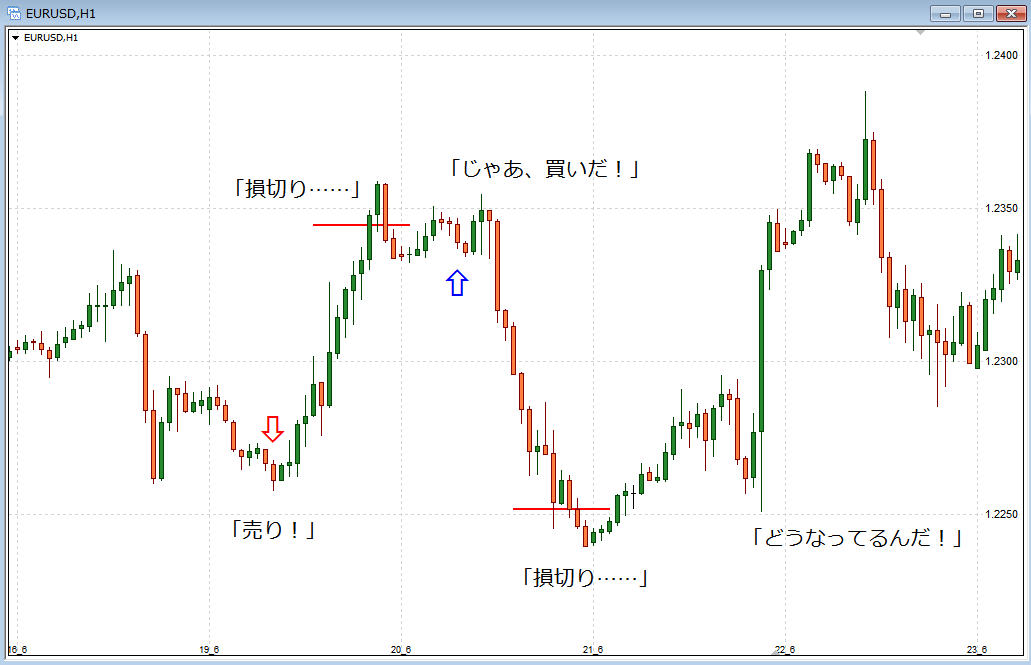

下のユーロドル1時間足チャートは、売って損切り、買って損切りという、往復ビンタの典型パターンを示したものです。

FXで往復ビンタが起きる原因の多くは、レンジ相場のなかでの安易なブレイクアウト狙いのエントリーをすることにあると考えられます。

上のチャートは、まさにそういった状況になっていて、高値や安値を少し更新したかと思うと、また反対側へとレートが動いていく、いわゆる「ブロードニング フォーメーション」と呼ばれるチャートパターンが形成されています。

こうした往復ビンタが起きやすいのは、一見するとトレードしやすく感じられる「値が動く時間帯におけるボラティリティの高い相場状況」だといえます。

短時間に一方向へ為替レートが動くものの、実際にはその値動きの中でブレイクを狙うと、どうしても伸び切ったタイミングでのエントリーになりやすいものです。

そのタイミングは大抵、目ざといトレーダーたちの利食いの場になる傾向が高く、高値づかみをさせられる可能性があります。

ブロードニング フォーメーションが形成されてしまうような相場状況は、さらに大きな時間足チャートを見てみれば、何らかのチャートポイントに到達していることがあります。

そうしたチャートポイントでは攻防が起きやすく、下位時間足では乱高下となる可能性があるのです。

そうした上位時間軸のチャートポイントは事前に把握することが可能ですので、往復ビンタの悲劇を避けるためにもマルチタイムフレーム分析を習得して、視野の広いチャート分析を行うことをおすすめします。

『ドテン(途転)』という言葉の由来

そもそもドテンという言葉は相場の世界でのスラング(俗語)であり、何かしら根拠のある用語というわけではありません。

ですので、その由来も諸説あり、決まった理由というものは無いようです。

その中でも一般的に言われている由来には以下のようなものがあります。

- 人が転んだり、ものをひっくり返したときの音を「ドテン」と表現することから、ポジションを反対方向へ「ひっくり返す」という意味で用いられるようになった。

- その後、「“途” 中でポジションの方向を “転” じる」という意味から「途転」という当て字が用いられるようになった。

ちなみに、株式相場や商品先物相場といった古い相場の世界では、ドテンは「損切り後に反対方向のポジションを持つこと」を指す言葉として用いられてきた経緯があります。

しかし現在では、ここまで解説してきたように「利益確定後に反転方向への流れに乗る目的でエントリーし直すこと」を含めてドテンと呼ぶようになっています。

ドテン(途転)について~まとめ

ドテン(途転)とは、今まで持っていたポジションを利益確定もしくは損切りした直後に、反対方向のポジションを持ち直す(再エントリーする)ことです。

ドテンは、事前にしっかりと過去チャート検証を通じて「優位性のあるトレードルール」として手法化しておくことが大切です。

FX初心者が損切りになってしまった感情に任せて行うドテンは「往復ビンタ」につながりやすく、短時間で大きな損失を生み出してしまう危険なトレードですので、損切り後のエントリーにはクールダウン時間を設けるなどして回避しなくてはなりません。

以上、『ドテン(途転)』とは?往復ビンタを避けるやり方とFX手法──についてお伝えしました。

こちらの記事もおすすめです