あなたは「ロング・ショート」の意味をご存知ですか?

この「ロング・ショート」という言葉の意味と由来には、FXの「ある重要な値動きの特徴」が秘められていると聞いたら、どうですか?

今回は、ロングとショートの意味と由来、FXの値動きの特徴について解説していきます。これを知ればあなたも、チャートにあらわれる集団心理を上手く利用できるかもしれません。

『ロング・ショート』の意味

言葉の意味自体はカンタンなので、サクッと紹介しておきましょう。

「ロング」とは「買い」をあらわす言葉で、「ロング・エントリーした」といえば「買いでエントリーした」という意味になります。

「ショート」とは「売り」をあらわす言葉で、同じように、「ショート・エントリーした」といえば「売りでエントリーした」という意味です。

このように、FXでは「ロング=買い」「ショート=売り」という意味でつかいます。

「ロング・ショート」の語源についてはこの記事の最後に解説しますが、「ショート」という言葉は文字通り「短い(短期間)」という意味があります。

そして、この「ショート」という言葉には、相場の値動きの重要な特徴が込められているのです。

「ショート」があらわす、値動きの重要な特徴

「ショート」という言葉が表す、相場の値動きの重要な特徴とは何でしょうか?

それは、値動きが上昇するときよりも、下落するときの方が「短期間で動く」ということです。

つまり、上昇は長い時間(ロング・タイム)が掛かりますが、下落は短期間(ショート・タイム)で起きるのです。

ということは、売りのトレードは、買いよりも短期間で利益目標に到達する可能性があるわけで、相場局面によっては売りが有利だということです。

これはFXを含めて、あらゆる相場に共通して見られる特徴です。

下落が短期間でおきる理由

なぜ、下落するときは短期間で起きるのでしょうか?

そこには心理的な背景があります。

人間は出来るだけリスクを避けようとする生き物で、これは人類が何百万年もかけて受け継いできた遺伝子レベルでの本能です。

現代でも、突然の自然災害に代表されるように、いつどんな危険がやってくるか分かりませんし、そうなってしまったら全力で危険から逃げなくてはいけません。

ですから、目の前に「下落!?」というリスクが現れたとき、この「リスクを回避しようとする本能」によって、パニック的な行動をとってしまうのです。

これが、なだれのような「売り」を呼び起こし、とても早い(ショート・タイムな)下落となってあらわれるのです。

※こうした本能的な行動のリスクとその解決方法については、以下の記事を参考にして下さい。

FXは買いも売りも同じはずなのでは?

それにしても、売り(空売り)が特殊な株式相場ならともかく、買いも売りも同じようにエントリーできるFXでも下落が短期間(ショートタイム)で起きるのは、なぜなのでしょう?

これも心理的な要因だと考えると、つじつまが合ってきます。

つまり、FXチャートの視覚的な要因です。

世界中のトレーダーが見ているFXチャートは基本的にどれも同じで、ドル円なら、ドルの価値が上がればチャートは上昇を示し、下がれば下落を示します。

人は視覚的にチャートが上昇しているのを見ると、「価値が増えている」とか「安全に上向いている」という印象をもってしまうものなのです。

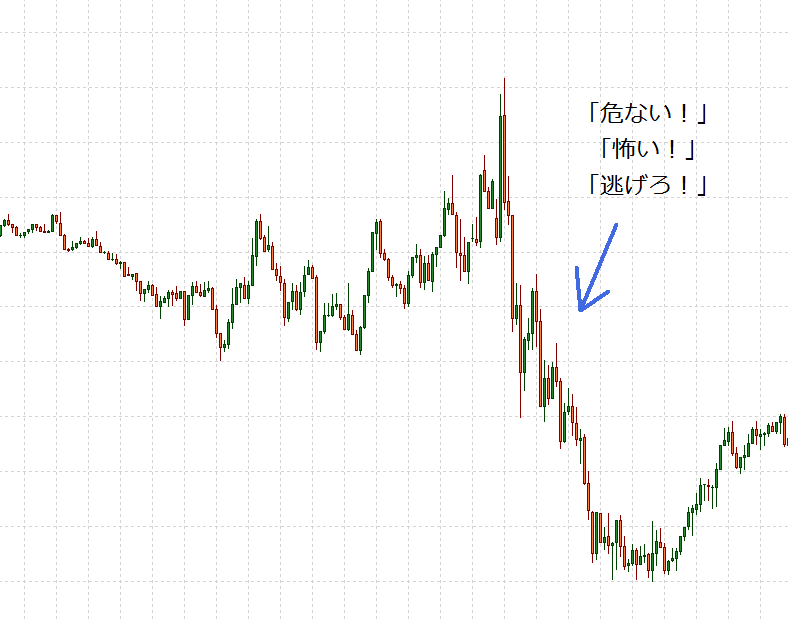

反対にチャートが下落していると、「危ない!」「怖い!」「逃げろ!」という印象を強くもってしまうのです。

俗語に「ガラる(暴落する)」という言葉がありますが、これも「ナイアガラの滝のように激しく落ちる」という意味が込められているものです。

実際あなたも、下のようなチャートを見たらそんな風に感じませんか?

※以下、チャートをクリックすると拡大します。

「下落は短期間(ショートタイム)で動く」は本当か?

とはいうものの、「下落するときの方が短期間(ショートタイム)で動く」というのは本当なのか、まだ半信半疑だと思いますので、色々な通貨ペアのチャートを見てみることにしましょう。

日足や1時間足だと、そうなっている場面だけを抜き出すことも可能なので、過去何十年もの値動きを丸々みることができる「月足」でチェックしていきましょう。

月足は、一本のローソク足に「一ヶ月間の攻防」が凝縮されていますから、それだけ多くの相場参加者の意図や行動を見て取ることが出来るものだといえます。

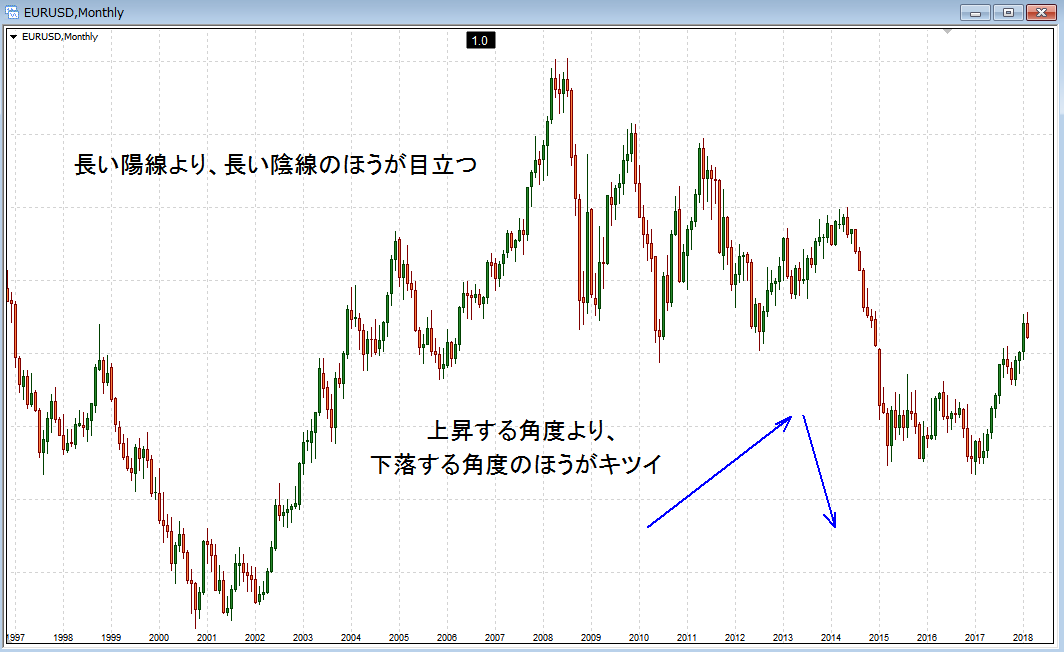

まずは、ユードドルの月足チャートです。

いかがでしょうか。長い陽線よりも、長い陰線のほうが目立ちませんか?

それに、上昇する角度よりも下落するときの角度のほうがキツく、一気に崩れていっている印象がありませんか?

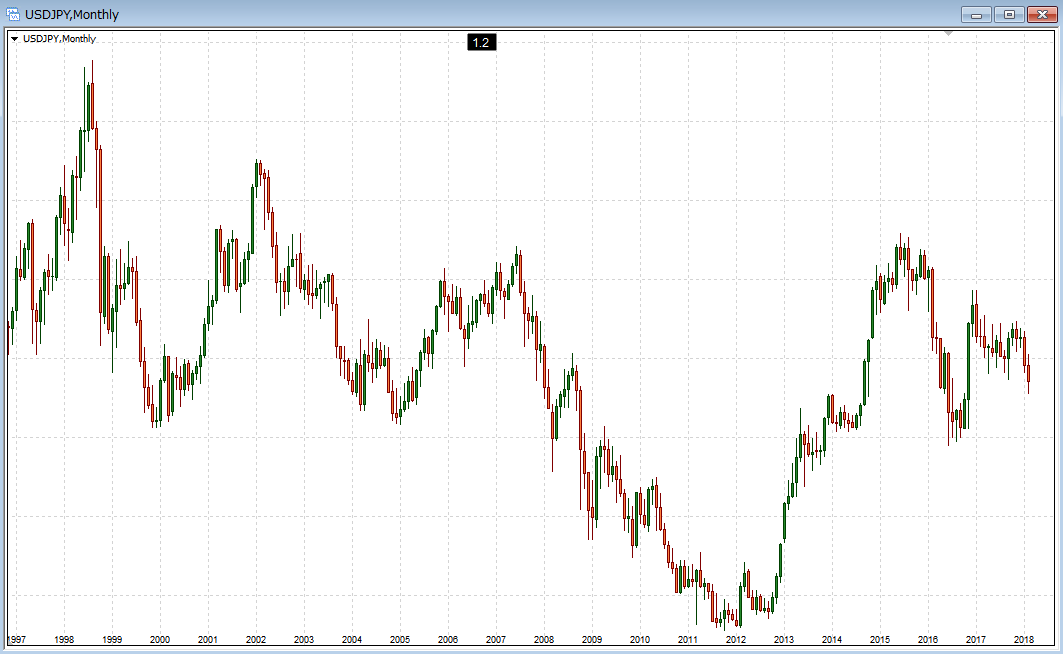

次は、ドル円の月足チャートです。

これも同様の傾向が見られませんか?

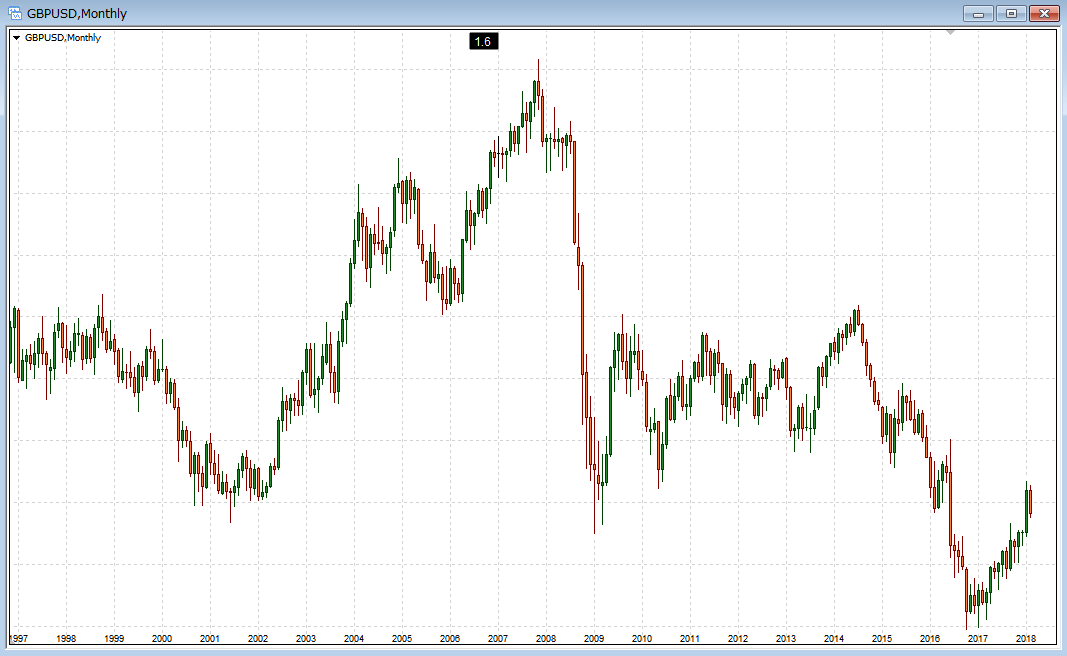

どんどんいきましょう。次は、ポンドドルの月足チャートです。

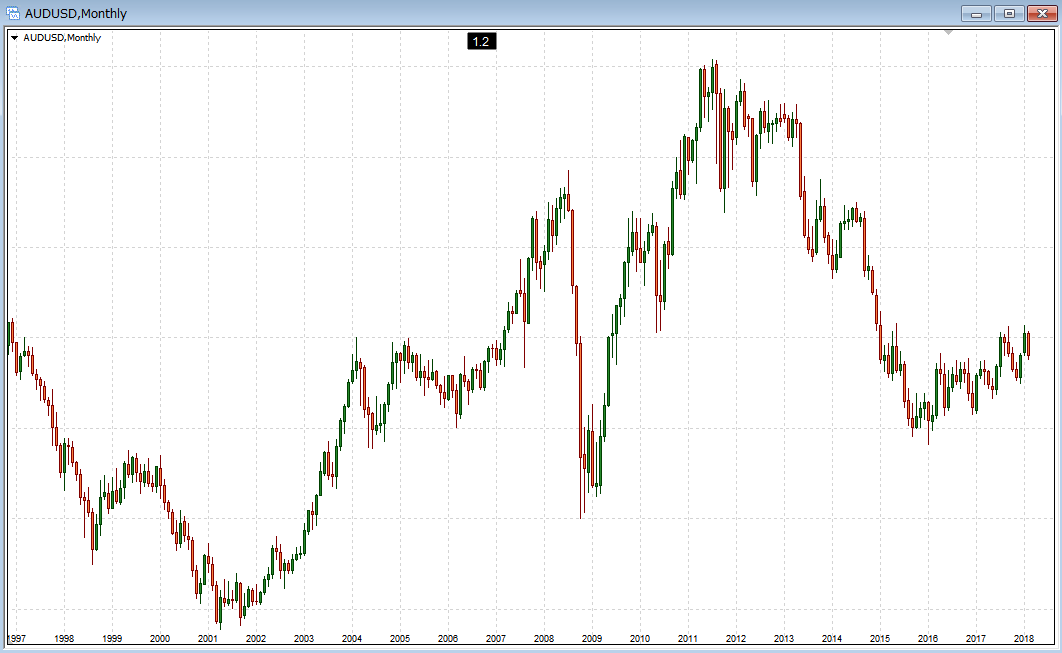

こちらは、豪ドルの月足チャートです。

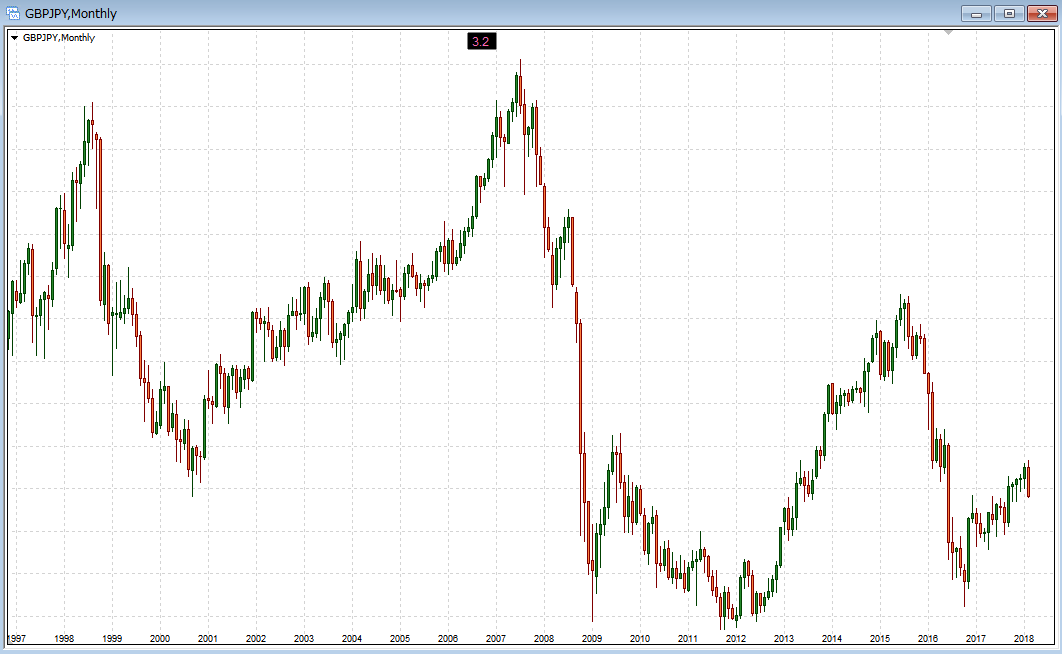

もうひとつ、ポンド円の月足チャートです。

──こういう風に、長い陽線よりも長い陰線のほうが目立つ傾向があったり、上昇する角度よりも下落するときの角度のほうがキツく、一気に崩れていっているのが分かると思います。

まさに「ショート」です。

実際のトレード中にも意識してみよう

この傾向を意識しながら日々のトレードをしていると、例えば5分足チャートでも日々、パニック的なショートタイムの下落が起きていることに気づくでしょう。

こういうところにも、FXの値動きの「フラクタル構造」が顔を出しているのです。

「ロング」「ショート」と呼ばれる由来

「ロング・ショート」という言葉は、もともと信用取引の用語であり、株の信用取引や先物取引で使われているものです。

そして、FXも信用取引のひとつなので、この「ロング・ショート」がつかわれています。

信用取引とは?

自前の資金だけではなく、証券会社から一時的にお金や株券を借りて、レバレッジという仕組みをつかってトレードをする取引方法のこと。

FXも、FX口座へ入金した証拠金を元手にして、レバレッジを掛けて大きな取引をするという、信用取引なのです。

レバレッジについては、以下の記事で解説していますので、参考にして下さい。

株の場合、基本的には買った株が値上がりしていくのを、時間を掛けて待つものといえます。つまり、買った株が長期的に価値を上げていくのを期待するわけです。

ですから「買い」のことを「ロング(長期)」と呼ぶようになったと言われています。

しかし当然、何らかの事情で下落することがあるわけですが、そうしたときの損失をカバーするために、その株を空売りするという方法が取られることがあります。

FXだと、買いでも売りでも同じようにトレードできますから当たり前に思えますが、株の世界では、売りというのは特殊なトレードと位置づけられています。

ともあれ、信用取引によって資金を借りて空売りをするということは、株を買って持ち続けるのとは事情が違います。空売りの資金は証券会社から借りているもの(立て替えてもらっているもの)ですから、期日には返済する必要があるため、自ずと短期決戦になります。

そのため「売り」のことを「ショート(短期)」と呼ぶようになったと言われています。

『ロング・ショート』~まとめ

「ロング」とは「買い」を、「ショート」とは「売り」をあらわす言葉です。

そして、「ショート」という言葉は、「下落するときの方が短期間で動く」という事実が由来になっていて、FX相場の値動きの重要な特徴をあらわしています。

あなたもこれからは、下落(ショート)の動きにしっかりと注目してみてはいかがでしょうか?

以上、『ロング・ショート』とは?その意味と由来が表すFXの値動きの特徴について、お伝えしました。

こちらの記事もおすすめです